Sinclair, Inc. Forms Golden Cross, Signaling Potential Bullish Breakout Ahead

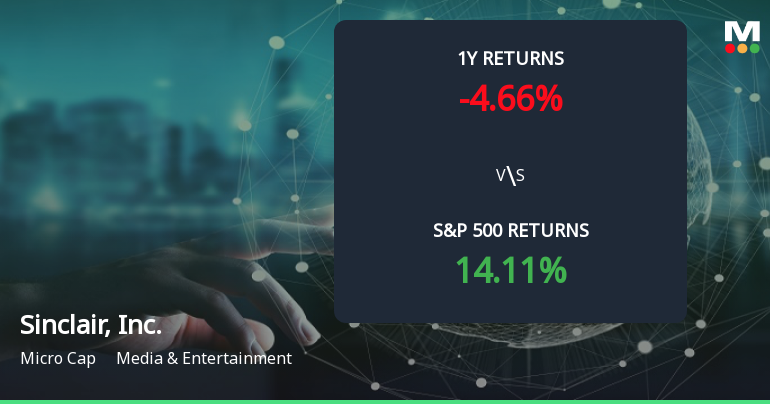

2025-12-12 15:19:20Sinclair, Inc. has recently achieved a Golden Cross, indicating a potential shift in market sentiment. Despite a challenging year, the stock has shown resilience with notable daily and weekly gains, suggesting a possible increase in investor confidence. Technical indicators remain bullish, prompting interest in future performance trends.

Read full news articleNo announcement available

Corporate Actions

No corporate action available