Key Events This Week

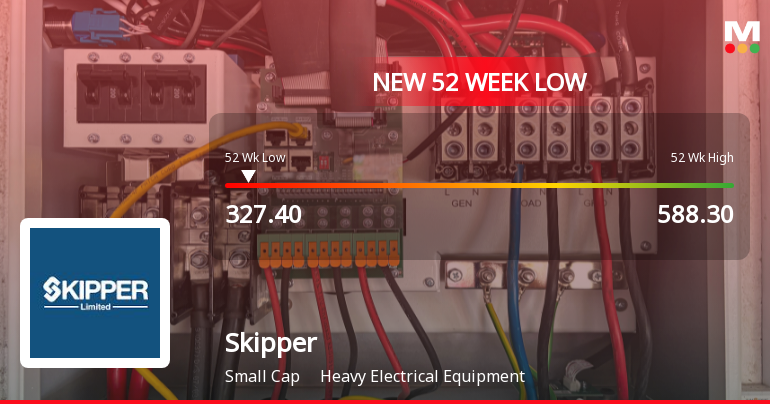

Jan 27: Stock hits 52-week low of Rs.331.35

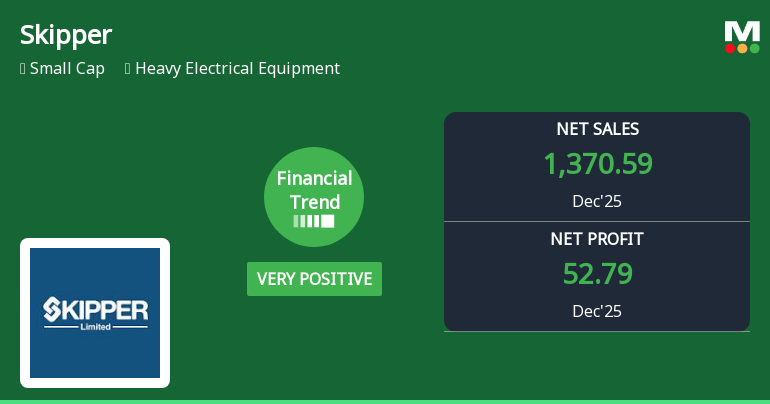

Jan 29: Q2 FY26 results reveal growth momentum with margin pressure

Jan 30: Very positive quarterly financial performance reported

Jan 30: Week closes at Rs.361.20 (+6.86%)

Skipper Ltd Reports Very Positive Quarterly Financial Performance Amid Market Challenges

2026-01-30 08:00:26Skipper Ltd, a key player in the Heavy Electrical Equipment sector, has demonstrated a marked improvement in its financial performance for the quarter ended December 2025. The company’s financial trend has shifted from positive to very positive, driven by record-breaking revenue, profit margins, and operational efficiency metrics, signalling a robust turnaround against a challenging market backdrop.

Read full news articleAre Skipper Ltd latest results good or bad?

2026-01-29 19:20:19Skipper Ltd's latest financial results for Q2 FY26 present a mixed picture of operational performance. The company reported net sales of ₹1,261.79 crores, reflecting a year-on-year growth of 13.70%, which indicates sustained revenue momentum despite a modest sequential growth of 0.63%. This suggests that while Skipper is managing to maintain its market presence, the pace of expansion may be moderating as the fiscal year progresses. On the profitability front, net profit for the quarter was ₹37.03 crores, which shows a year-on-year increase of 12.45%. However, it experienced a sequential decline of 18.18%, raising concerns about earnings quality and sustainability. The PAT margin compressed to 2.93% from 3.61% in the previous quarter, primarily due to rising interest costs and a significant drop in other income, which decreased to ₹4.07 crores from ₹9.07 crores in the prior quarter. The operating margin, h...

Read full news article

Skipper Ltd Q2 FY26: Growth Momentum Meets Margin Pressure

2026-01-29 16:04:16Skipper Limited, the Kolkata-based heavy electrical equipment manufacturer, reported consolidated net profit of ₹37.03 crores for Q2 FY26, marking a sequential decline of 18.18% from Q1 FY26's ₹45.26 crores but delivering a healthy year-on-year growth of 12.45% from ₹32.93 crores in Q2 FY25. The company, which commands a market capitalisation of ₹4,116 crores, saw its stock decline 0.94% to ₹360.00 following the results announcement, reflecting investor concerns about sequential margin compression despite sustained top-line momentum.

Read full news article

Skipper Ltd Stock Falls to 52-Week Low of Rs.331.35 Amid Market Underperformance

2026-01-27 10:35:04Skipper Ltd, a key player in the Heavy Electrical Equipment sector, touched a new 52-week low of Rs.331.35 today, marking a significant decline amid broader market movements and sectoral pressures. The stock has underperformed both its sector and the broader market indices over the past year, reflecting a challenging phase for the company’s share price.

Read full news article

Skipper Ltd is Rated Sell by MarketsMOJO

2026-01-27 10:10:35Skipper Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 08 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 27 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Skipper Ltd Stock Falls to 52-Week Low of Rs.337.8 Amid Market Downturn

2026-01-23 14:18:46Shares of Skipper Ltd, a key player in the Heavy Electrical Equipment sector, declined sharply to a new 52-week low of Rs.337.8 on 23 Jan 2026, reflecting a significant underperformance relative to the broader market and sector indices.

Read full news article

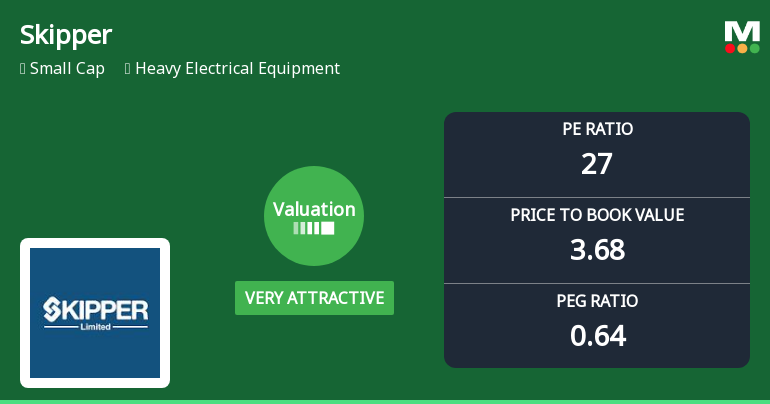

Skipper Ltd Valuation Shifts to Very Attractive Amid Market Pressure

2026-01-09 08:00:45Skipper Ltd, a key player in the Heavy Electrical Equipment sector, has seen its valuation parameters shift markedly, moving from an attractive to a very attractive rating despite recent share price declines. This change reflects a significant reappraisal of the company’s price-to-earnings and price-to-book value ratios relative to its historical averages and peer group, offering investors a fresh perspective on its price attractiveness amid broader market volatility.

Read full news article