SkyWest Stock Forms Death Cross, Signaling Potential Bearish Trend Ahead

2025-12-01 16:00:56SkyWest, Inc. has recently encountered a Death Cross, indicating a potential shift in market sentiment. Technical indicators suggest a bearish outlook, with the stock underperforming over the past year. However, it has shown short-term resilience, outperforming the S&P 500 in the last week, despite ongoing caution in overall trends.

Read full news article

SkyWest, Inc. Experiences Revision in Its Stock Evaluation Amid Mixed Market Metrics

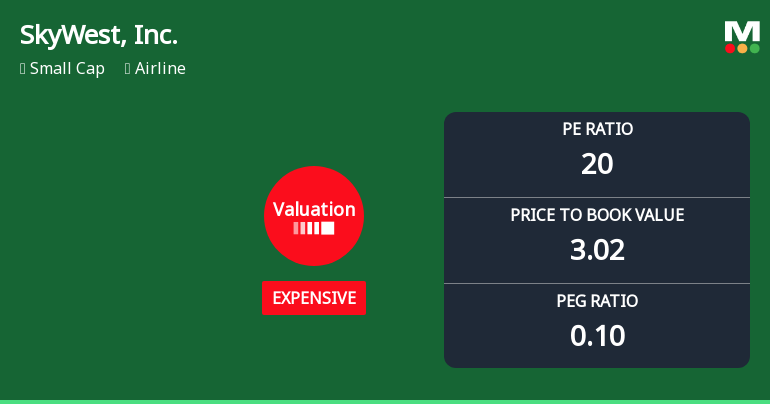

2025-11-03 15:55:19SkyWest, Inc. has adjusted its valuation, with a P/E ratio of 20 and a low PEG ratio of 0.10, indicating potential growth value. Compared to peers, its metrics vary, and while its one-year stock performance lags behind the S&P 500, it has significantly outperformed over three years.

Read full news article

SkyWest, Inc. Experiences Valuation Adjustment Amid Competitive Airline Sector Landscape

2025-10-27 15:57:34SkyWest, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 20 and a price-to-book value of 3.02. Its financial metrics, including EV to EBIT and EV to EBITDA ratios, highlight its competitive positioning within the airline sector compared to peers with varied valuation profiles.

Read full news article