Sonu Infratech Ltd is Rated Sell

2026-03-04 10:10:55Sonu Infratech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 Feb 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 04 March 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

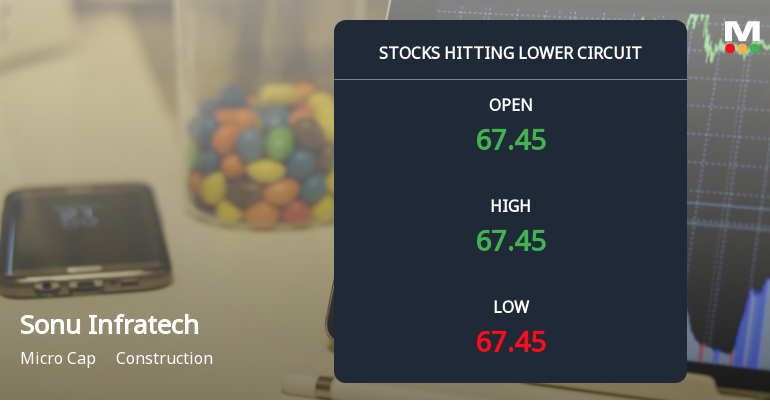

Sonu Infratech Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-03-04 10:00:52Shares of Sonu Infratech Ltd, a micro-cap player in the construction sector, plunged to their lower circuit limit on 4 March 2026, marking a maximum daily loss of 5.0%. The stock closed at ₹67.45, down ₹3.55 from the previous close, as panic selling gripped investors amid deteriorating fundamentals and weak market sentiment.

Read full news article

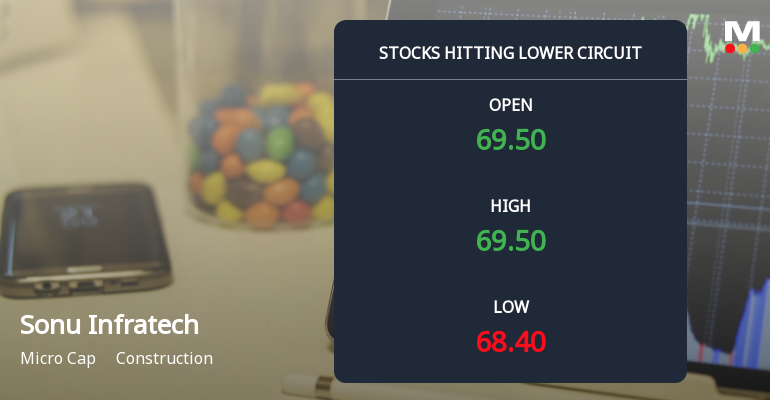

Sonu Infratech Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

2026-02-26 10:00:19Shares of Sonu Infratech Ltd plunged to their lower circuit limit on 26 Feb 2026, closing at ₹68.4, down 5.0% on the day. The stock’s sharp decline was driven by intense selling pressure and panic among investors, pushing it close to its 52-week low and underperforming both its sector and the broader market indices.

Read full news article

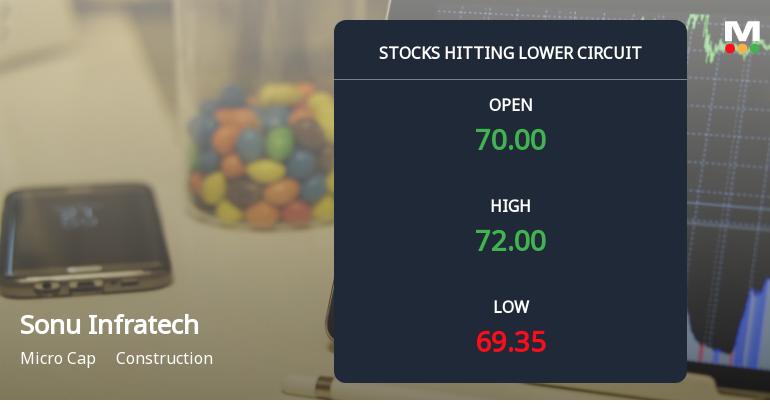

Sonu Infratech Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-02-25 14:00:17Shares of Sonu Infratech Ltd, a micro-cap player in the construction sector, plunged to their lower circuit limit on 25 Feb 2026, closing at ₹72.00 after a steep intraday fall. The stock faced intense selling pressure, registering a maximum daily loss of 1.37%, underperforming both its sector and the broader market indices. This sharp decline reflects mounting investor concerns amid unfilled supply and panic selling, pushing the stock closer to its 52-week low.

Read full news article

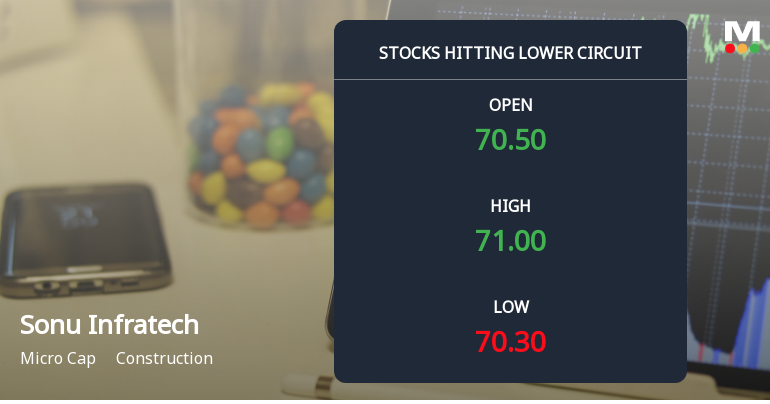

Sonu Infratech Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

2026-02-24 10:00:25Shares of Sonu Infratech Ltd, a micro-cap player in the construction sector, plunged to their lower circuit limit on 24 Feb 2026, registering a maximum daily loss of 5.0%. The stock closed at ₹70.3, down ₹3.7 from the previous close, reflecting intense panic selling and unfilled supply in the market. This sharp decline outpaced both the broader Sensex, which fell 0.89%, and the construction sector’s modest 0.39% loss, signalling sector-specific distress for the company.

Read full news article

Sonu Infratech Ltd is Rated Sell

2026-02-21 10:10:44Sonu Infratech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 February 2026. While the rating was revised on that date, the analysis and financial metrics discussed here reflect the stock's current position as of 21 February 2026.

Read full news article

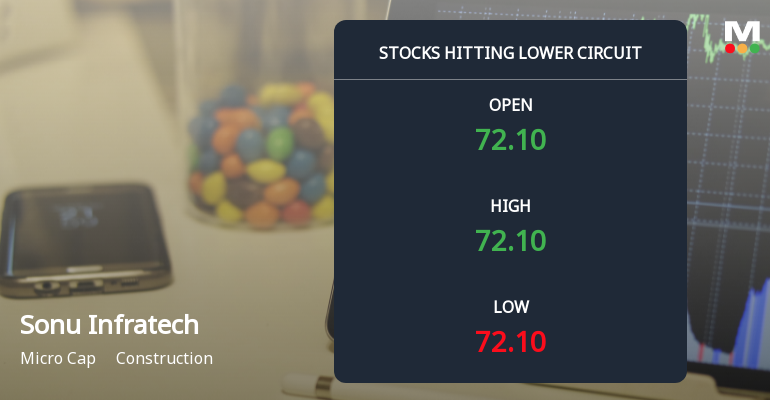

Sonu Infratech Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-02-20 12:00:09Shares of Sonu Infratech Ltd, a micro-cap player in the construction sector, plunged sharply on 20 Feb 2026, hitting the lower circuit limit of ₹72.10. The stock recorded a maximum daily loss of 4.94%, underperforming both its sector and the broader market amid intense selling pressure and a marked decline in investor participation.

Read full news article

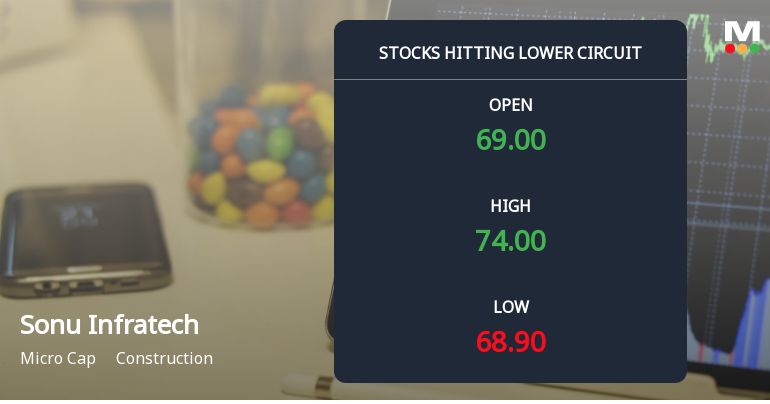

Sonu Infratech Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-02-18 11:00:13Shares of Sonu Infratech Ltd, a micro-cap player in the construction sector, plunged to their lower circuit limit on 18 Feb 2026, reflecting intense selling pressure and panic among investors. The stock closed at ₹74.00, marking a maximum daily loss of 2.07%, as unfilled supply overwhelmed demand in a thinly traded session.

Read full news article

Sonu Infratech Ltd is Rated Strong Sell

2026-02-10 10:11:11Sonu Infratech Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 09 February 2026. However, the analysis and financial metrics presented here reflect the stock's current position as of 10 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news articleCorporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available