Southern Petrochemical Industries Corporation Ltd. is Rated Sell

2026-02-03 10:16:54Southern Petrochemical Industries Corporation Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 05 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 03 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Southern Petrochemical Industries Corporation Ltd. Stock Hits 52-Week Low at Rs.69.13

2026-02-02 09:45:55Southern Petrochemical Industries Corporation Ltd. (SPIC) has declined to a fresh 52-week low of Rs.69.13, marking a significant price level that reflects ongoing pressures in the stock. The share price has been on a downward trajectory for the past four consecutive sessions, resulting in a cumulative loss of 5.3% during this period.

Read full news article

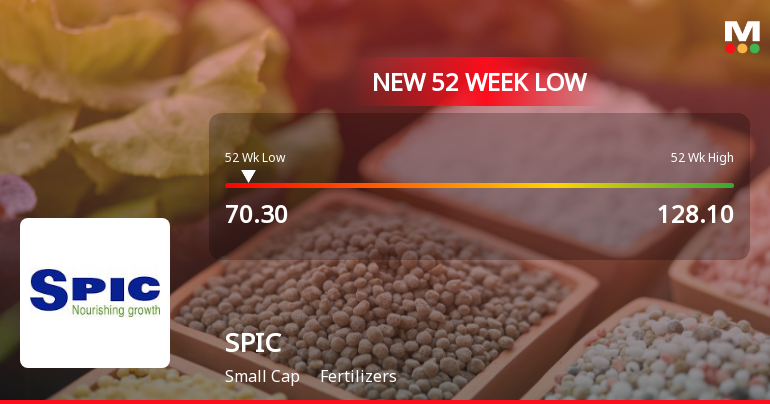

Southern Petrochemical Industries Corporation Ltd. Stock Hits 52-Week Low

2026-02-01 16:00:37Southern Petrochemical Industries Corporation Ltd. (SPIC) has touched a new 52-week low, closing near Rs 70.3, marking a significant milestone in its recent price trajectory. This development reflects ongoing pressures on the stock within the fertilizers sector, as it continues to underperform key benchmarks and faces subdued institutional participation.

Read full news article

Southern Petrochemical Industries Corporation Ltd. Stock Hits 52-Week Low at Rs.70.3

2026-01-28 09:47:24Southern Petrochemical Industries Corporation Ltd. (SPIC) touched a fresh 52-week low of Rs.70.3 today, marking a significant price level amid a challenging year for the fertiliser sector stock. Despite a slight intraday recovery, the stock remains below all major moving averages, reflecting ongoing pressures in the market.

Read full news article

Southern Petrochemical Industries Corporation Ltd. Stock Hits 52-Week Low at Rs.70.3

2026-01-28 09:47:16Southern Petrochemical Industries Corporation Ltd. (SPIC) touched a new 52-week low of Rs.70.3 today, marking a significant price level for the fertiliser sector stock amid a mixed market environment. Despite outperforming its sector by 0.54% during the trading session, the stock opened with a gap down of -2.21% and remains below all key moving averages, reflecting ongoing pressures.

Read full news article

Southern Petrochemical Industries Corporation Ltd. Falls to 52-Week Low of Rs.70.77

2026-01-27 10:06:23Southern Petrochemical Industries Corporation Ltd. (SPIC) has declined to a fresh 52-week low of Rs.70.77, marking a significant price level for the fertiliser sector stock amid a subdued market environment. The stock has underperformed its sector and benchmark indices, reflecting ongoing concerns despite some positive financial indicators.

Read full news article

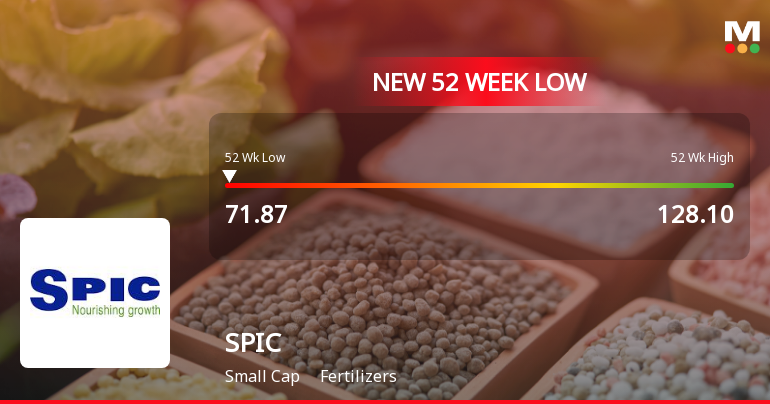

Southern Petrochemical Industries Corporation Ltd. Stock Falls to 52-Week Low of Rs.71.87

2026-01-23 14:13:40Southern Petrochemical Industries Corporation Ltd. (SPIC) has declined to a fresh 52-week low of Rs.71.87, marking a significant price level for the fertiliser sector stock amid broader market weakness and persistent underperformance relative to benchmarks.

Read full news article

Southern Petrochemical Industries Corporation Ltd. is Rated Sell

2026-01-23 10:11:17Southern Petrochemical Industries Corporation Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 05 Jan 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 23 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Southern Petrochemical Industries Corporation Ltd. is Rated Sell

2026-01-12 10:10:52Southern Petrochemical Industries Corporation Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 05 Jan 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 12 January 2026, providing investors with the most up-to-date perspective on its fundamentals, returns, and market standing.

Read full news articleStandalone & Consolidated Financial Results Limited Review Report for September 30 2025

14-Nov-2025 | Source : BSESouthern Petrochemicals Industries Corporation Ltd has informed BSE about :

1. Standalone Financial Results for the period ended September 30 2025

2. Consolidated Financial Results for the period ended September 30 2025

3. Standalone Limited Review for the period ended September 30 2025

4. Consolidated Limited Review for the period ended September 30 2025

5. Standalone Cash Flow Statement for the period ended September 30 2025

6. Consolidated Cash Flow Statement for the period ended September 30 2025

Revised Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

05-Sep-2025 | Source : BSEThe Exchange has received the revised disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Sicagen India Ltd

Revised Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

05-Sep-2025 | Source : BSEThe Exchange has received the revised disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for South India House Estates and Properties Ltd

Corporate Actions

No Upcoming Board Meetings

Southern Petrochemical Industries Corporation Ltd. has declared 20% dividend, ex-date: 16 Sep 25

No Splits history available

No Bonus history available

No Rights history available