Key Events This Week

Jan 19: Stock opens at Rs.194.15, down 1.62% amid broad market weakness

Jan 20: Continued decline to Rs.190.40, MarketsMOJO downgrades rating to Strong Sell

Jan 21: Bearish momentum intensifies, stock closes at Rs.186.20

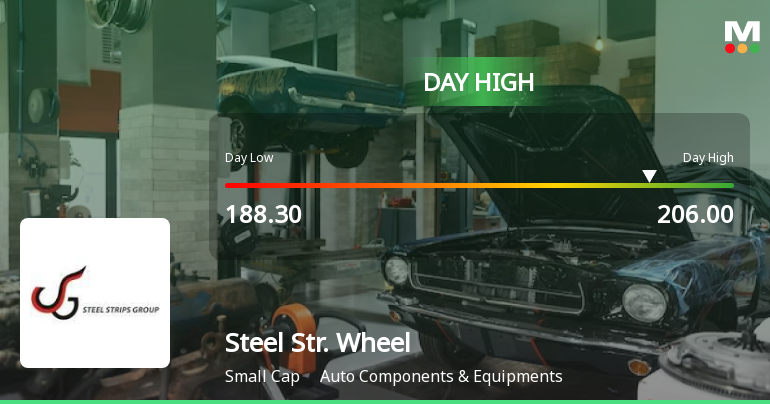

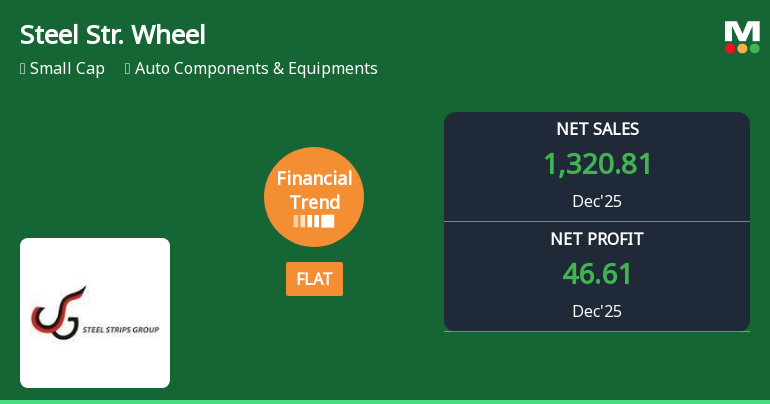

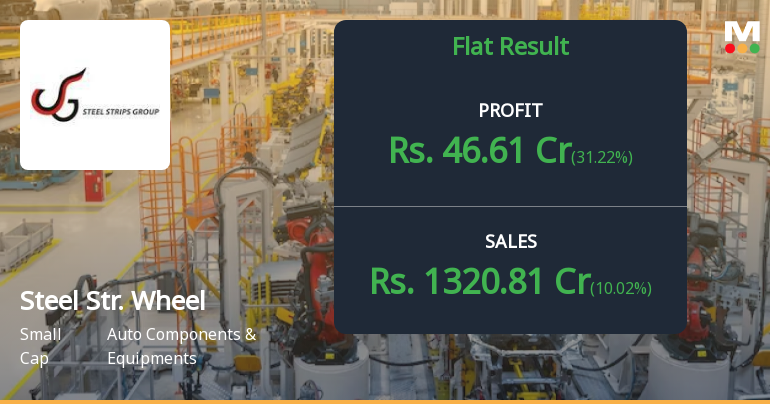

Jan 22: Slight recovery to Rs.186.25 as quarterly results show revenue surge but margin pressures

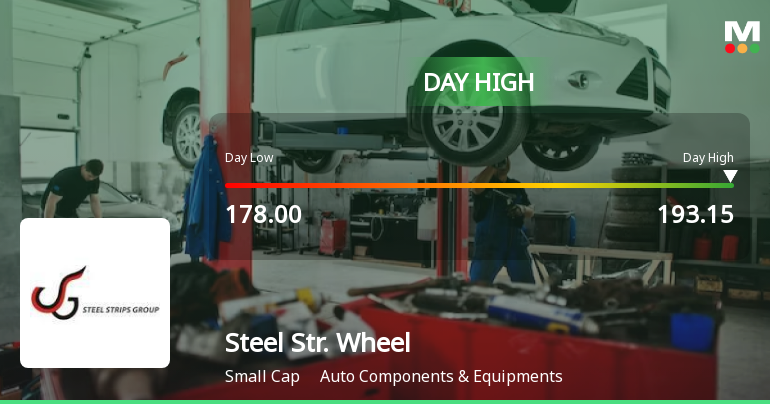

Jan 23: Week closes at Rs.179.50, down 3.62% on the day amid margin concerns