Stratasys Ltd. Stock Plummets to New 52-Week Low at $8.13

2025-11-24 16:23:03Stratasys Ltd. has reached a new 52-week low of USD 8.13, reflecting a significant decline in its stock price over the past year. The company, with a market capitalization of USD 879 million, operates at a loss and has a negative return on equity, indicating financial challenges.

Read full news article

Stratasys Ltd. Stock Plummets to New 52-Week Low of $8.17

2025-11-21 15:54:12Stratasys Ltd. has reached a new 52-week low, reflecting a significant decline in its stock price over the past year. The company, with a market capitalization of USD 879 million, has reported negative returns and a substantial net loss, despite an increase in interest over recent months.

Read full news article

Stratasys Ltd. Stock Plummets to New 52-Week Low at $8.35

2025-11-20 16:36:19Stratasys Ltd. has reached a new 52-week low, reflecting a significant decline in its stock price over the past year. The company operates at a loss, with a negative price-to-earnings ratio and no dividends. Despite increased interest, net profit has decreased, raising concerns about its financial health.

Read full news article

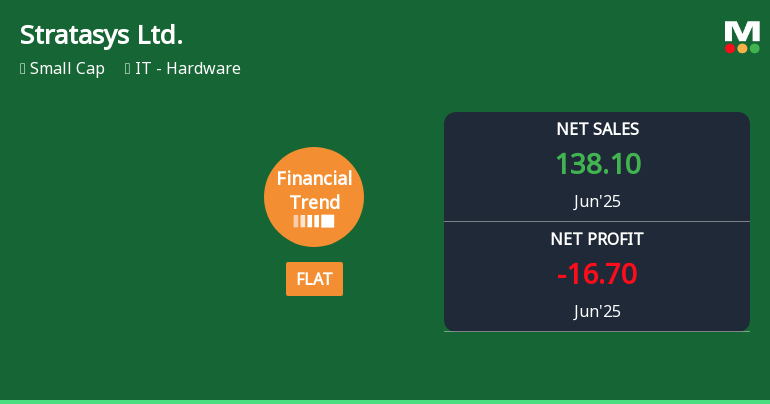

Stratasys Ltd. Experiences Revision in Its Stock Evaluation Amid Mixed Financial Trends

2025-11-20 15:37:00Stratasys Ltd. reported flat performance for the quarter ending June 2025, with operating cash flow at USD 11.93 million and a debt-equity ratio of -24.77%. However, the company faced challenges, including rising interest expenses and a net profit loss of USD -16.75 million for the quarter.

Read full news article

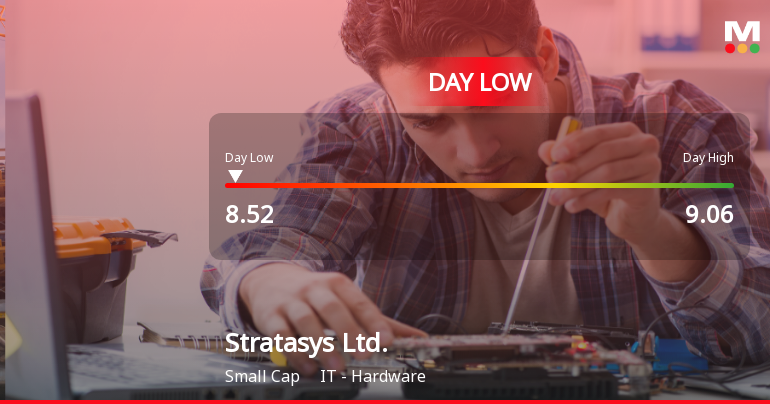

Stratasys Ltd. Hits Day Low of $8.52 Amid Price Pressure

2025-11-18 17:27:04Stratasys Ltd. has faced notable stock volatility, declining significantly today and over the past week and month. The company reported a substantial net loss and negative return on equity, indicating ongoing challenges in a competitive IT hardware market, with consistent underperformance compared to the S&P 500.

Read full news article