Sun Country Airlines Faces Valuation Shift Amid Declining Financial Performance

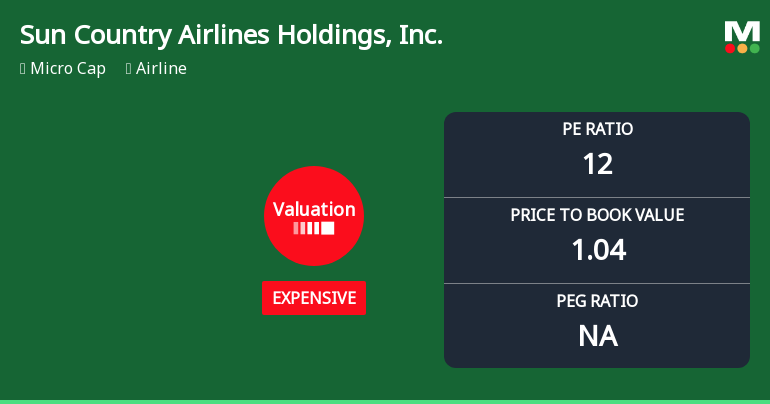

2025-10-28 19:04:29Sun Country Airlines Holdings, Inc. has experienced a change in its valuation grade, now categorized as expensive. This adjustment is influenced by various financial metrics, including a reported P/E ratio of 12 and a low debt to EBITDA ratio, despite challenges in recent financial performance.

Read MoreIs Sun Country Airlines Holdings, Inc. overvalued or undervalued?

2025-10-28 11:12:38As of 24 October 2025, the valuation grade for Sun Country Airlines Holdings, Inc. has moved from fair to expensive, indicating a shift towards overvaluation. The company appears overvalued based on its P/E ratio of 12, which is higher than its peer average P/E of approximately 11.62, and an EV to EBITDA ratio of 3.88, which is also above the peer comparison of 4.01. Additionally, the Price to Book Value stands at 1.04, suggesting that the stock is trading at a premium relative to its book value. In comparison to its peers, Air Transport Services Group, Inc. is considered very expensive with a P/E of 54.21, while Spirit Airlines, Inc. is classified as risky with a negative P/E. The recent performance of Sun Country Airlines against the S&P 500 is not available, but the overall valuation metrics suggest that investors may want to exercise caution given the current price levels....

Read More

Sun Country Airlines Experiences Valuation Adjustment Amidst Competitive Market Landscape

2025-10-27 16:14:12Sun Country Airlines Holdings, Inc. has adjusted its valuation, reflecting shifts in financial metrics and market standing. The airline's current price is $11.51, with key indicators including a P/E ratio of 12 and a return on capital employed of 13.96%. The airline maintains a competitive position relative to its peers.

Read MoreIs Sun Country Airlines Holdings, Inc. overvalued or undervalued?

2025-10-27 11:12:52As of 24 October 2025, the valuation grade for Sun Country Airlines Holdings, Inc. moved from fair to expensive, indicating that the stock is overvalued. The company exhibits a P/E ratio of 12, a Price to Book Value of 1.04, and an EV to EBITDA of 3.88, which are relatively high compared to its peers. For instance, Air Transport Services Group, Inc. has a significantly higher P/E ratio of 54.21, while Spirit Airlines, Inc. shows a negative P/E, emphasizing the mixed valuation landscape within the industry. Given these metrics, Sun Country Airlines appears overvalued, particularly when compared to its peer average P/E of approximately 11.62. The company's return performance against the S&P 500 is not available, but the recent price movement suggests a cautious outlook in the context of its valuation....

Read MoreIs Sun Country Airlines Holdings, Inc. overvalued or undervalued?

2025-10-26 11:09:20As of 24 October 2025, the valuation grade for Sun Country Airlines Holdings, Inc. has moved from fair to expensive, indicating a shift towards overvaluation. The company is currently considered overvalued, with a P/E ratio of 12, a Price to Book Value of 1.04, and an EV to EBITDA of 3.88. In comparison, peers such as Air Transport Services Group, Inc. have a significantly higher P/E ratio of 54.21, while Spirit Airlines, Inc. presents a risky valuation with a negative P/E ratio. The recent stock performance shows that Sun Country Airlines has underperformed relative to the S&P 500, with a year-to-date return of -21.06% compared to the S&P 500's gain of 15.47%. This underperformance reinforces the view that the stock may be overvalued at its current price of 11.51....

Read More

Sun Country Airlines Experiences Valuation Adjustment Amidst Competitive Market Landscape

2025-10-13 16:08:00Sun Country Airlines Holdings, Inc. has adjusted its valuation, reflecting its financial metrics and market position. The airline's P/E ratio is 12, with a price-to-book value of 1.04. Its operational efficiency is indicated by an EV to EBIT of 7.37 and a return on capital employed of 13.96%.

Read More

Sun Country Airlines Experiences Revision in Stock Evaluation Amid Market Volatility

2025-09-29 16:09:31Sun Country Airlines Holdings, Inc. has recently adjusted its technical trends, reflecting changes in performance indicators. The airline's stock shows significant volatility, with a 52-week high of $18.59 and a low of $8.10. Comparatively, its returns have lagged behind the S&P 500 over various periods.

Read More