SurgePays, Inc. Experiences Revision in Its Stock Evaluation Amid Mixed Financial Metrics

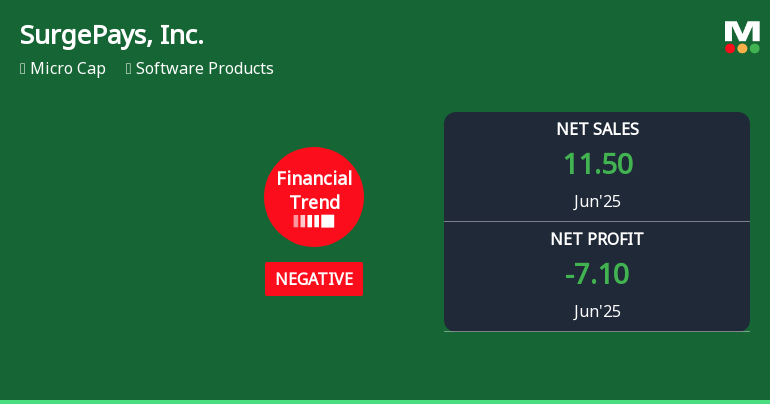

2025-11-19 15:49:03SurgePays, Inc. reported its highest operating profit for the quarter ending June 2025, despite a significant decline in net sales and operating cash flow. The company faces challenges with a low return on capital employed and a high debt-equity ratio, while its stock has outperformed the S&P 500 over the past year.

Read full news articleNo announcement available

Corporate Actions

No corporate action available