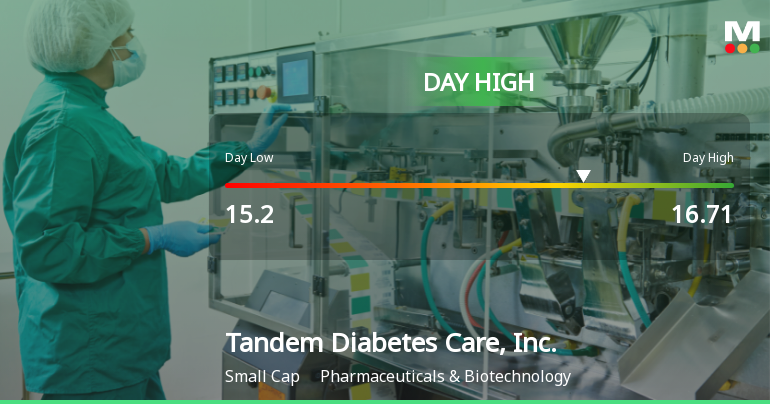

Tandem Diabetes Care Stock Soars 21.98%, Hits Intraday High of $16.70

2025-11-10 17:49:11Tandem Diabetes Care, Inc. has seen notable stock activity today, contrasting with the modest performance of the S&P 500. While the company has gained significantly over the past week, its year-long performance reveals a substantial decline. The firm continues to face challenges with profitability and has a market capitalization of USD 845 million.

Read More

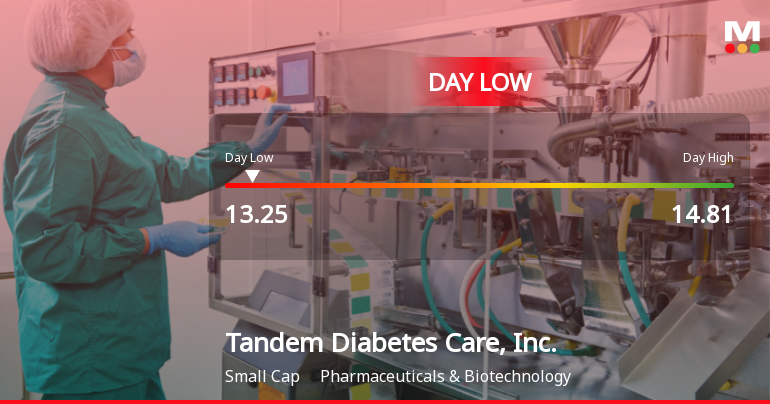

Tandem Diabetes Care Hits Day Low at $13.25 Amid Price Pressure

2025-11-07 16:37:17Tandem Diabetes Care, Inc. faced notable volatility on November 6, 2025, with a significant stock decline. Over the past week and month, the stock has continued to drop, reflecting a troubling long-term performance. Financial metrics reveal challenges, including low return on equity and high debt levels, indicating ongoing difficulties.

Read More

Tandem Diabetes Care Experiences Revision in Stock Evaluation Amid Market Fluctuations

2025-10-07 20:23:09Tandem Diabetes Care, Inc. has experienced significant stock fluctuations, with a 52-week high of $42.70 and a low of $9.98. Recent evaluations show mixed technical indicators, and the company's performance has lagged behind the S&P 500, reflecting ongoing challenges in the market.

Read MoreIs Tandem Diabetes Care, Inc. technically bullish or bearish?

2025-10-07 12:15:01As of 3 October 2025, the technical trend for Tandem Diabetes Care, Inc. has changed from bearish to mildly bearish. The weekly MACD indicates a mildly bullish stance, but the monthly MACD remains bearish. The daily moving averages are mildly bearish, and both the weekly and monthly Bollinger Bands are also mildly bearish. The KST and Dow Theory show bearish and mildly bearish signals respectively on the weekly and monthly time frames. In terms of performance, the stock has outperformed the S&P 500 over the past week and month, with returns of 27.31% and 19.32% compared to 1.09% and 4.15% for the index. However, the longer-term returns are significantly negative, with a year-to-date return of -58.33% and a one-year return of -64.07%, while the S&P 500 has gained 14.18% and 17.82% respectively. Overall, the current technical stance is mildly bearish....

Read More

Tandem Diabetes Care Stock Soars 12.2% to Intraday High of $14.85

2025-10-06 18:07:37Tandem Diabetes Care, Inc. saw a notable increase in its stock price on October 3, 2025, reflecting strong short-term performance compared to the S&P 500. However, the company faces long-term challenges, including significant declines over the past year and five years, alongside concerns regarding its financial health.

Read MoreIs Tandem Diabetes Care, Inc. technically bullish or bearish?

2025-10-06 12:05:11As of 3 October 2025, the technical trend for Tandem Diabetes Care, Inc. has changed from bearish to mildly bearish. The weekly MACD is mildly bullish, but the monthly MACD remains bearish. The Bollinger Bands and moving averages indicate a mildly bearish stance on both weekly and daily time frames. The KST and Dow Theory show bearish and mildly bearish signals, respectively, on the weekly and monthly charts. In terms of returns, Tandem has significantly underperformed the S&P 500 over the year with a return of -63.64% compared to the S&P's 17.82%, and over three years, it has returned -70.92% against the S&P's 82.57%. Overall, the current technical stance is mildly bearish....

Read MoreIs Tandem Diabetes Care, Inc. technically bullish or bearish?

2025-10-05 11:50:04As of 3 October 2025, the technical trend for Tandem Diabetes Care, Inc. has changed from bearish to mildly bearish. The weekly MACD indicates a mildly bullish stance, while the monthly MACD remains bearish. The Bollinger Bands and moving averages are both showing mildly bearish signals on the weekly and daily time frames. The KST and Dow Theory are bearish and mildly bearish, respectively, on the weekly and monthly charts. In terms of performance, the stock has significantly underperformed the S&P 500 over the longer term, with a year-to-date return of -59.16% compared to the S&P 500's 14.18%, and a one-year return of -63.64% versus the S&P 500's 17.82%. Overall, the current technical stance is mildly bearish, with key indicators such as the moving averages and Bollinger Bands contributing to this view....

Read More