Key Events This Week

Feb 23: Stock opens at Rs.52.55, down 3.95% amid broader Sensex gains

Feb 24: Recovery with 3.10% gain to Rs.54.18 despite Sensex decline

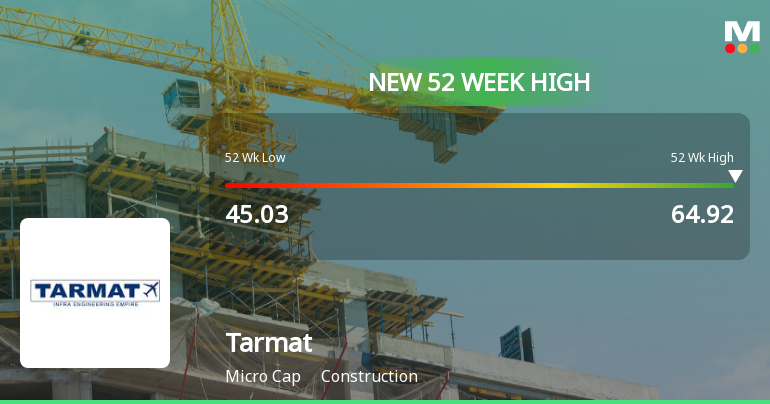

Feb 26: Stock hits new 52-week high of Rs.64.92 and upper circuit limit

Feb 27: New 52-week high at Rs.72, closing at Rs.71.00 (+9.37%)