TEGNA, Inc. Experiences Valuation Adjustment Amid Mixed Competitive Landscape in Media Sector

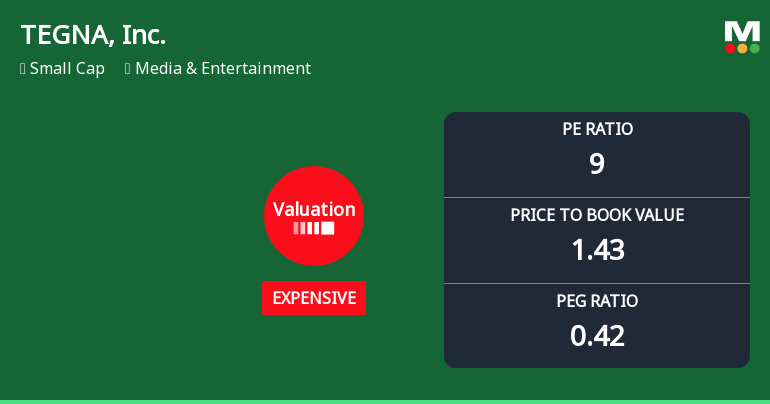

2025-11-10 15:59:21TEGNA, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 9 and a price-to-book value of 1.43. The company demonstrates a commitment to shareholders with a 2.25% dividend yield, while its year-to-date performance is 9.08%, trailing the S&P 500's return.

Read full news articleNo announcement available

Corporate Actions

No corporate action available