Key Events This Week

2 Feb: Technical momentum shift signals bearish outlook

6 Feb: Q2 FY26 results reveal core operational struggles masked by other income

Week Close: Rs.96.51 (-0.40%) vs Sensex +1.51%

Texmaco Infrastructure Q2 FY26: Other Income Masks Core Operational Struggles

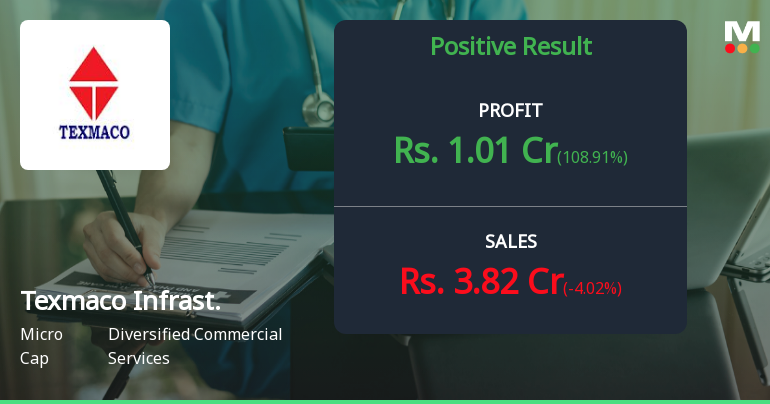

2026-02-06 21:03:54Texmaco Infrastructure & Holdings Ltd., a KK Birla Group company operating in diversified commercial services, reported a consolidated net profit of ₹5.95 crores in Q2 FY26, representing a remarkable 126.24% year-on-year growth from ₹2.63 crores in Q2 FY25. However, this headline figure conceals a troubling underlying reality: the company's core operations continue to bleed, with operating profit excluding other income remaining deeply negative at ₹0.28 crores loss. The stock, currently trading at ₹96.51 with a market capitalisation of ₹1,254 crores, has declined 2.16% following the results announcement, reflecting investor scepticism about the sustainability of earnings driven predominantly by non-operating income.

Read full news article

Texmaco Infrastructure & Holdings Ltd Faces Technical Momentum Shift Amid Bearish Signals

2026-02-02 08:04:00Texmaco Infrastructure & Holdings Ltd has experienced a notable shift in its technical momentum, with key indicators signalling a transition from a sideways trend to a mildly bearish stance. Despite a modest daily decline of 2.06%, the stock’s technical parameters reveal a complex interplay of bearish and mildly bullish signals, prompting investors to reassess its near-term prospects within the diversified commercial services sector.

Read full news articleTexmaco Infrastructure Gains 2.00%: 2 Key Factors Driving the Week

2026-01-31 15:07:03

Key Events This Week

27 Jan: Downgrade to Strong Sell amid weak fundamentals

30 Jan: Technical momentum shifts amid mixed signals

30 Jan: Week closes at Rs.96.90 (+2.00%) outperforming Sensex

Texmaco Infrastructure & Holdings Ltd: Technical Momentum Shifts Amid Mixed Market Signals

2026-01-30 08:01:47Texmaco Infrastructure & Holdings Ltd has experienced a notable shift in its technical momentum, moving from a mildly bearish stance to a sideways trend, reflecting a complex interplay of technical indicators. Despite a modest daily price increase of 0.80% to ₹94.30, the stock remains under pressure with a strong sell rating and a Mojo Score of 23.0, signalling caution for investors amid mixed signals from key momentum and trend indicators.

Read full news article

Texmaco Infrastructure Downgraded to Strong Sell Amidst Weak Fundamentals and Negative Returns

2026-01-28 08:11:26Texmaco Infrastructure & Holdings Ltd has been downgraded from a Sell to a Strong Sell rating by MarketsMOJO as of 27 Jan 2026, reflecting deteriorating fundamentals, weak valuation metrics, and negative technical signals. Despite some positive quarterly results, the company’s overall financial health and market performance have raised significant concerns among analysts and institutional investors alike.

Read full news article

Texmaco Infrastructure & Holdings Ltd is Rated Sell

2026-01-22 10:10:04Texmaco Infrastructure & Holdings Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 18 Dec 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 22 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news articleFinancial Results For The Quarter And Nine Months Ended 31St December 2025

06-Feb-2026 | Source : BSEFinancial Results for the Quarter and Nine months ended 31st December 2025

Board Meeting Outcome for Outcome Of Board Meeting Held On 6Th February 2026

06-Feb-2026 | Source : BSEOutcome of Board Meeting held on 6th February 2026

Announcement under Regulation 30 (LODR)-Change in Management

06-Feb-2026 | Source : BSERe-appointment of Internal Auditor and Cost Auditor

Corporate Actions

No Upcoming Board Meetings

Texmaco Infrastructure & Holdings Ltd has declared 15% dividend, ex-date: 12 Sep 25

Texmaco Infrastructure & Holdings Ltd has announced 1:10 stock split, ex-date: 01 Jan 09

No Bonus history available

No Rights history available