Key Events This Week

2 Feb: Stock surged 4.25% to Rs.688.05 despite Sensex decline

3 Feb: Q3 FY26 results revealed exceptional other income masking weak core operations

4 Feb: Stabilised quarterly performance reported amid margin pressures; stock rose 2.87%

6 Feb: Stock declined 4.62% to close the week at Rs.672.45

The Peria Karamalai Tea & Produce Company Ltd is Rated Strong Sell

2026-02-06 10:10:50The Peria Karamalai Tea & Produce Company Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 06 January 2026. However, the analysis and financial metrics presented here reflect the stock’s current position as of 06 February 2026, providing investors with the most up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

The Peria Karamalai Tea & Produce Company Ltd Reports Stabilised Quarterly Performance Amid Margin Pressures

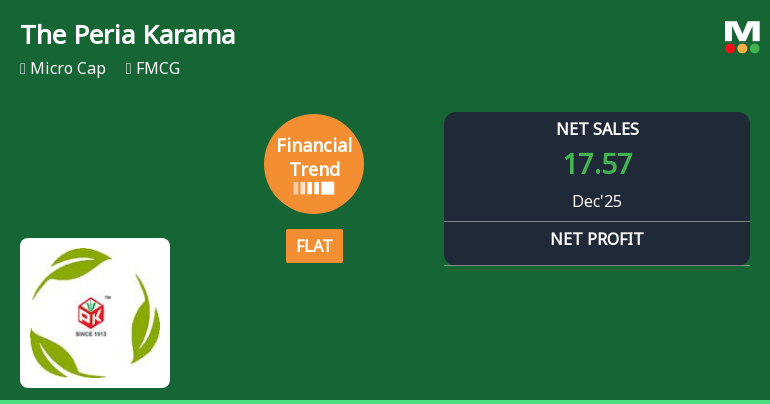

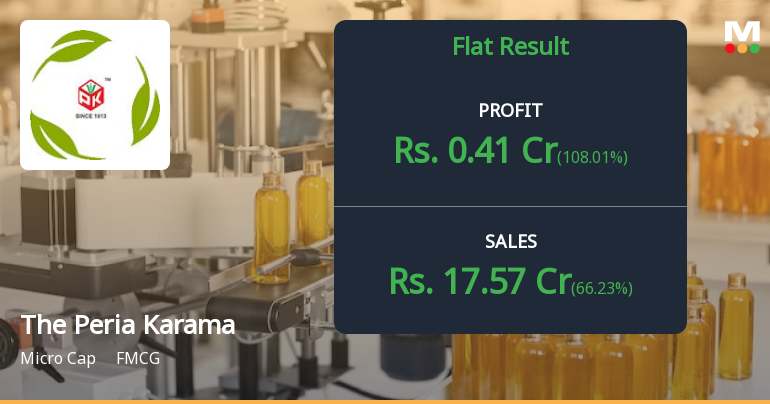

2026-02-04 08:00:09The Peria Karamalai Tea & Produce Company Ltd has reported a flat financial performance for the quarter ended December 2025, signalling a stabilisation after a period of negative trends. While net sales reached a quarterly high of ₹17.57 crores and profit before tax excluding other income surged by nearly 291%, the company continues to grapple with a low return on capital employed and a significant proportion of profits derived from non-operating income. This mixed performance has led to an upgrade in the company’s Mojo Grade from Sell to Strong Sell, reflecting cautious optimism amid ongoing challenges.

Read full news articleAre The Peria Karamalai Tea & Produce Company Ltd latest results good or bad?

2026-02-03 19:15:25The Peria Karamalai Tea & Produce Company Ltd's latest financial results for Q3 FY26 indicate a complex operational landscape. The company reported net sales of ₹17.57 crores, which reflects a significant year-on-year increase of 30.43%. This marks a quarterly high and shows a notable recovery from previous periods. However, the quality of earnings remains a concern, as the net profit of ₹0.88 crores is heavily influenced by non-operating income, which accounted for a substantial portion of profitability. Operating margins, excluding other income, improved to 11.13%, up from 6.96% in the same quarter last year, suggesting some operational recovery. Nonetheless, this improvement follows a history of operating losses, raising questions about sustainability. The company's return on equity (ROE) remains low at 1.88%, indicating challenges in capital utilization and operational efficiency. Over the nine-month ...

Read full news article

The Peria Karamalai Tea Q3 FY26: Exceptional Other Income Masks Weak Core Operations

2026-02-03 15:02:29The Peria Karamalai Tea & Produce Company Ltd., a century-old tea producer with estates in high-yielding zones, delivered a mixed performance in Q3 FY26, with net profit surging to ₹0.88 crores compared to ₹0.03 crores in the year-ago quarter. However, the impressive bottom-line growth conceals troubling operational weakness, as the company's core tea business continues to struggle with negative operating margins. The stock, currently trading at ₹692.00 with a market capitalisation of ₹220.00 crores, has underperformed the broader market with a 21.55% decline year-to-date.

Read full news article

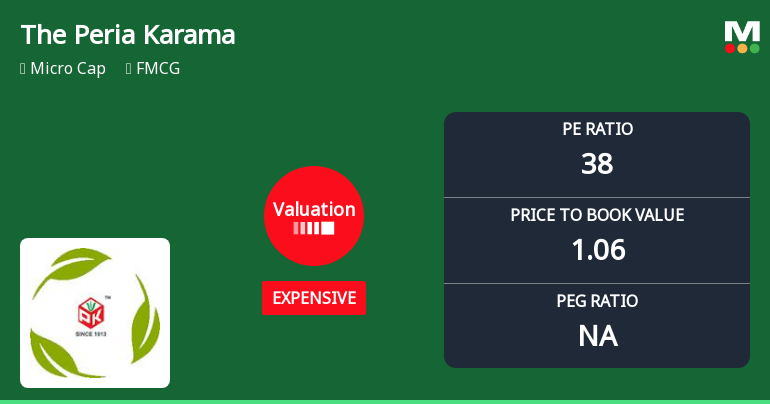

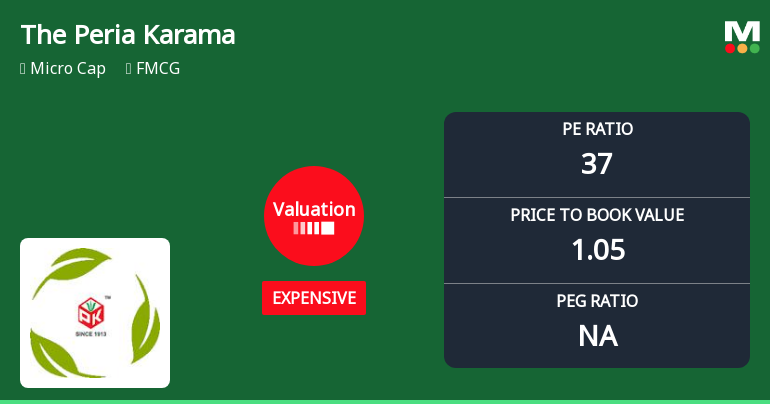

The Peria Karamalai Tea & Produce Company Ltd: Valuation Shifts Signal Price Attractiveness Change

2026-01-29 08:00:22The Peria Karamalai Tea & Produce Company Ltd has recently undergone a notable shift in its valuation parameters, moving from a 'very expensive' to an 'expensive' rating. This change, coupled with a downgrade in its Mojo Grade to Strong Sell, reflects evolving market perceptions amid subdued financial performance and challenging sector dynamics. This article analyses the company's current valuation metrics in comparison to its historical averages and peer group, providing a comprehensive view of its price attractiveness and investment implications.

Read full news article

Peria Karamalai Tea & Produce Company Ltd is Rated Strong Sell

2026-01-26 10:10:05Peria Karamalai Tea & Produce Company Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 06 Jan 2026, reflecting a significant reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 26 January 2026, providing investors with the latest perspective on the company’s position.

Read full news article

Peria Karamalai Tea & Produce Company Ltd is Rated Strong Sell

2026-01-15 10:10:15Peria Karamalai Tea & Produce Company Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 06 Jan 2026, reflecting a significant reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 15 January 2026, providing investors with the latest comprehensive view of the company’s position.

Read full news article

Peria Karamalai Tea & Produce Company Ltd Faces Valuation Reassessment Amidst Market Pressure

2026-01-14 08:00:15Peria Karamalai Tea & Produce Company Ltd has experienced a notable shift in its valuation parameters, moving from a very expensive to an expensive rating. This change reflects evolving market perceptions amid a challenging price performance, with the stock declining 4.9% on 14 Jan 2026 and showing significant underperformance against the Sensex over multiple time frames.

Read full news article