Walt Disney Co. Experiences Revision in Its Stock Evaluation Amid Market Dynamics

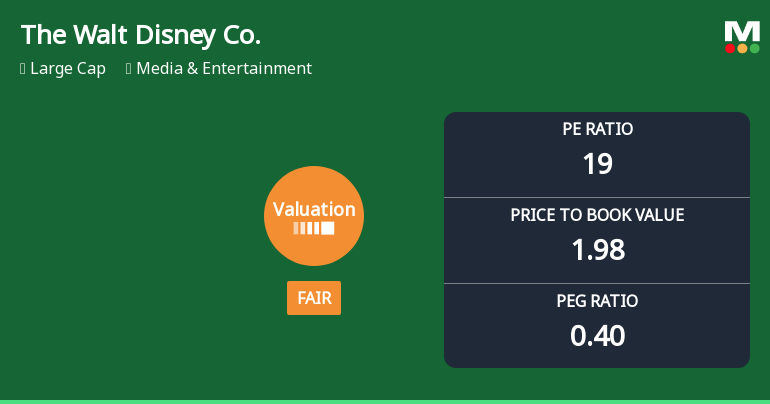

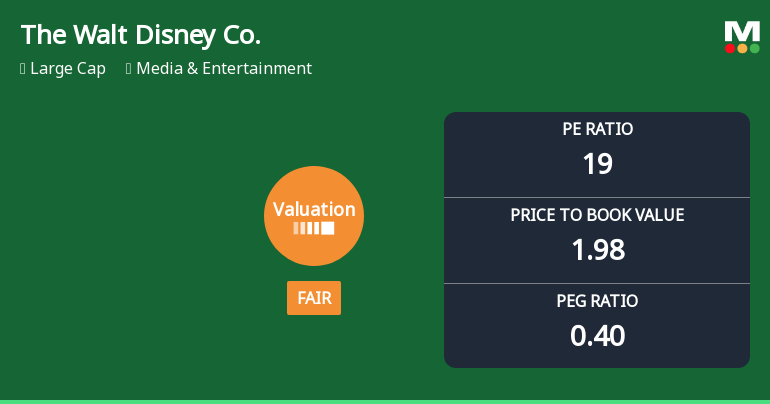

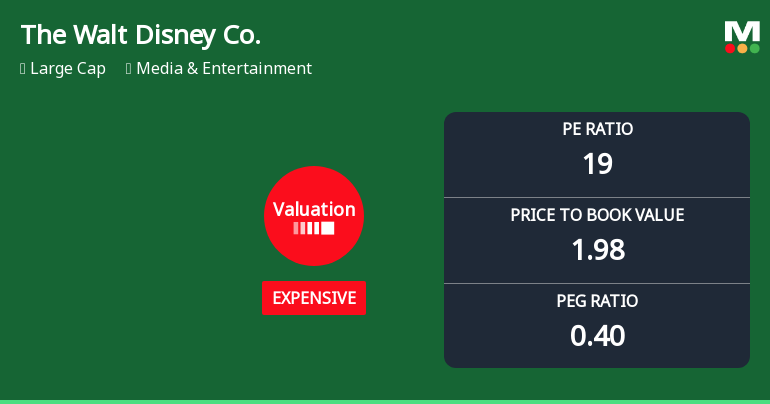

2025-11-24 15:27:01The Walt Disney Co. has adjusted its valuation amid changes in financial metrics and market dynamics. With a P/E ratio of 19 and a low PEG ratio of 0.40, the company faces mixed performance compared to the S&P 500, indicating challenges and the need for strategic enhancements.

Read full news article

Walt Disney Co. Experiences Revision in Stock Evaluation Amid Financial Trend Adjustments

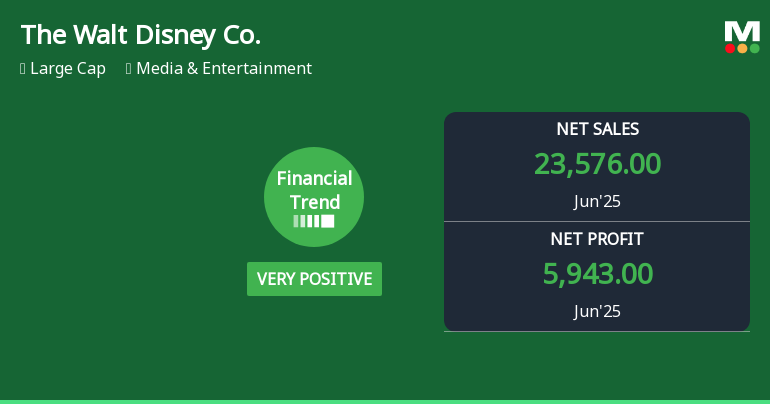

2025-11-20 15:32:24The Walt Disney Co. reported strong operating cash flow and a record return on capital employed, alongside a low debt-equity ratio, indicating solid financial health. However, challenges include a low inventory turnover ratio and liquidity concerns, as reflected in cash reserves, amidst underperformance compared to the S&P 500.

Read full news articleIs The Walt Disney Co. overvalued or undervalued?

2025-11-18 11:13:07As of 14 November 2025, the valuation grade for The Walt Disney Co. moved from fair to attractive, indicating a more favorable assessment. The company appears undervalued, supported by a P/E ratio of 19, a PEG ratio of 0.40, and an EV to EBITDA ratio of 13.28. In comparison, a peer company has a P/E of 15.26, suggesting that Disney's valuation may be more appealing relative to its peers. Despite recent struggles, with a one-year return of -8.16% compared to the S&P 500's 13.19%, the long-term outlook shows a 3-year return of 15.57%, although this still lags behind the S&P 500's 70.17%. Overall, the current valuation metrics and the grade change indicate that The Walt Disney Co. presents a potentially attractive investment opportunity....

Read full news article

Walt Disney Co. Experiences Revision in Stock Evaluation Amidst Market Dynamics

2025-11-17 15:31:28The Walt Disney Co. has adjusted its valuation, showcasing various financial metrics such as a P/E ratio of 19 and a low PEG ratio of 0.40, indicating growth potential. Despite a substantial dividend yield and competitive returns, Disney's stock performance has underperformed compared to the S&P 500.

Read full news articleIs The Walt Disney Co. overvalued or undervalued?

2025-11-17 11:07:40As of 14 November 2025, the valuation grade for The Walt Disney Co. has moved from fair to attractive, indicating a shift towards being undervalued. The company appears to be undervalued based on its valuation metrics, including a P/E ratio of 19, a PEG ratio of 0.40, and an EV to EBITDA ratio of 13.28. Comparatively, its peer, which has a P/E of 15.26 and an EV to EBITDA of 13.46, suggests that Disney is positioned favorably within its industry. Despite recent underperformance, with a year-to-date return of -4.98% compared to the S&P 500's 14.49%, the long-term outlook remains positive, as evidenced by a 3-year return of 12.22% against the S&P 500's 70.17%. This performance, alongside the attractive valuation ratios, reinforces the conclusion that The Walt Disney Co. is currently undervalued....

Read full news articleIs The Walt Disney Co. overvalued or undervalued?

2025-11-16 11:04:27As of 14 November 2025, the valuation grade for The Walt Disney Co. moved from fair to attractive, indicating a more favorable assessment of its value. The company is currently considered undervalued based on its financial metrics. Key ratios include a P/E ratio of 19, an EV to EBITDA of 13.28, and a PEG ratio of 0.40, all suggesting that the stock is trading at a discount relative to its earnings growth potential. In comparison to its peers, The Walt Disney Co. has a P/E ratio of 15.2554, which is lower than the industry average, indicating that it may be undervalued relative to its competitors. Additionally, the company’s EV to EBITDA ratio of 13.4579 further supports this valuation perspective. Notably, over the past three years, the stock has returned 12.22%, significantly lagging behind the S&P 500's return of 70.17%, reinforcing the notion that the stock may be undervalued in the current market conte...

Read full news article

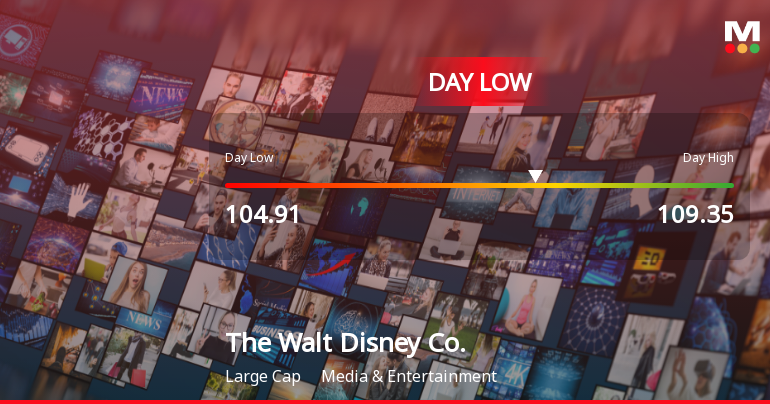

Walt Disney Co. Hits Day Low of $104.91 Amid Price Pressure

2025-11-14 16:15:27The Walt Disney Co. saw a notable decline in its stock price, contrasting with a slight increase in the S&P 500. Despite recent fluctuations, Disney reported a significant net profit growth of 60.67% in its latest quarterly results, highlighting a complex financial landscape amid a year-to-date performance lag.

Read full news article

Disney Stock Opens with Gap Down Amid Market Concerns and Weak Start

2025-11-14 16:05:10The Walt Disney Co. faced a notable stock decline today, contributing to a one-day performance that contrasts with the S&P 500. Over the past month, Disney's stock has also underperformed. The company has a market capitalization of approximately USD 215.9 billion and a P/E ratio of 19.00.

Read full news article

Walt Disney Co. Experiences Revision in Its Stock Evaluation Amid Market Dynamics

2025-11-10 15:34:36The Walt Disney Co. has adjusted its valuation, showcasing various financial metrics such as a P/E ratio of 19 and a low PEG ratio of 0.40, indicating growth potential. Despite mixed performance results compared to the S&P 500, Disney maintains competitive valuation metrics within the media and entertainment industry.

Read full news article