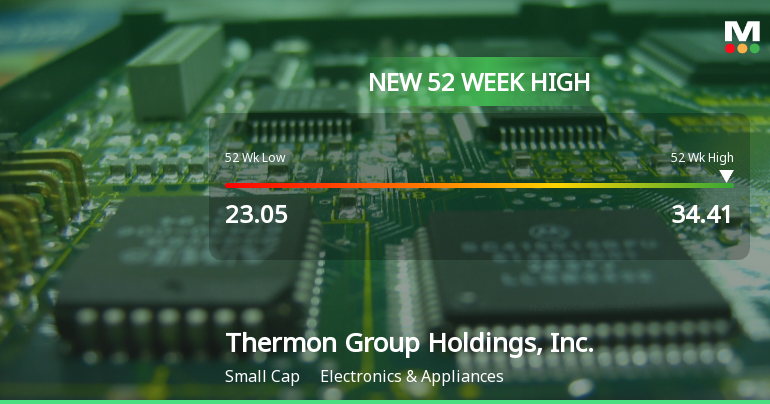

Thermon Group Holdings Hits New 52-Week High at $34.41

2025-11-10 17:12:47Thermon Group Holdings, Inc. has achieved a new 52-week high, reflecting its performance in the Electronics & Appliances sector. The company has shown an 11.72% increase over the past year, with a P/E ratio of 17.00 and a conservative debt-to-equity ratio of 0.20, indicating prudent financial management.

Read full news articleNo announcement available

Corporate Actions

No corporate action available