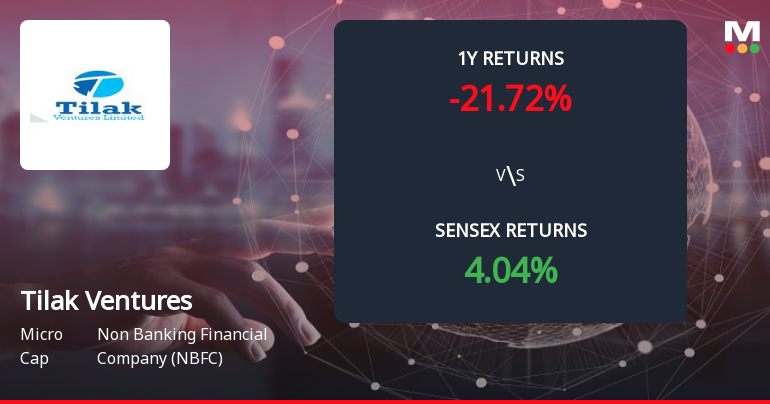

Short-Term Price Movement and Market Comparison

Tilak Ventures’ recent price action has been under pressure, with the stock falling by 7.69% over the past week, in stark contrast to the Sensex’s 1.00% gain during the same period. This divergence highlights the stock’s underperformance relative to the broader market. The decline over the last two days alone accounts for a 6.15% loss, signalling a sustained short-term downtrend. Today’s 7.22% drop further emphasises this negative momentum, with the stock also underperforming its sector by 5.7% on the day.

Technical Indicators and Moving Averages

From a technical standpoint, Tilak Ventures is trading above its 50-day, 100-day, and 200-day moving averages, which generally indicates a longer-term bul...

Read More