Key Events This Week

Feb 9: Stock opens at Rs.3,381.50, up 3.79%

Feb 10: Continued gains with Rs.3,496.25 close (+3.39%)

Feb 12: Minor dip to Rs.3,507.25 (-0.33%) amid Sensex decline

Feb 13: Strong quarterly results announced; stock closes at Rs.3,599.45 (+2.63%)

Are Triton Valves Ltd latest results good or bad?

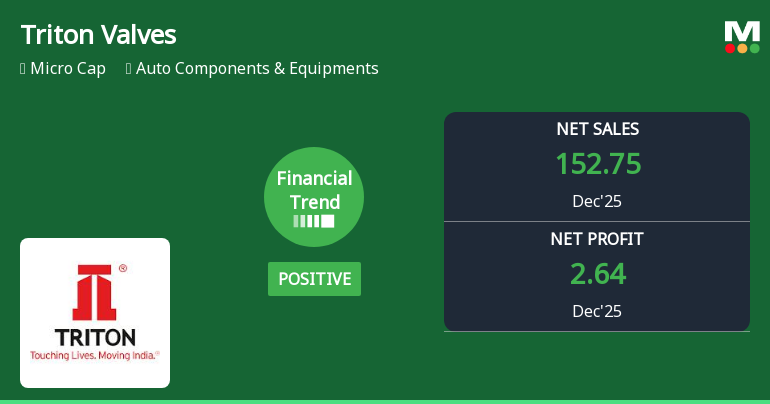

2026-02-13 19:52:50Triton Valves Ltd has reported its financial results for the quarter ended December 2025, showcasing significant operational momentum. The company achieved its highest quarterly revenue to date, with net sales reaching ₹152.75 crores, reflecting a year-on-year growth of 25.57% and a sequential growth of 16.06%. This growth is attributed to strengthening demand dynamics within the automotive components sector, particularly as original equipment manufacturers increased production during the festive season. In terms of profitability, Triton Valves reported a net profit of ₹2.64 crores, which marks a substantial year-on-year increase of 146.73% and a quarter-on-quarter growth of 36.08%. The operating margin improved to 7.40%, representing an expansion of 128 basis points compared to the previous year, driven by better operating leverage and favorable raw material costs. Despite these positive operational tren...

Read full news article

Triton Valves Ltd Reports Strong Quarterly Upswing Amid Positive Financial Trend

2026-02-13 11:00:49Triton Valves Ltd, a key player in the Auto Components & Equipments sector, has demonstrated a marked improvement in its financial performance for the quarter ended December 2025. The company’s financial trend has shifted from flat to positive, supported by record-high quarterly revenues and operating profits, signalling a robust turnaround after a challenging period.

Read full news article

Triton Valves Q3 FY26: Strong Profit Surge Masks Underlying Valuation Concerns

2026-02-13 09:39:10Triton Valves Ltd., India's leading manufacturer of tyre valves for the automobile industry, delivered a robust performance in Q3 FY26, with consolidated net profit surging 146.73% year-on-year to ₹2.64 crores from ₹1.07 crores in Q3 FY25. On a sequential basis, profit advanced 36.08% from ₹1.94 crores in Q2 FY26. However, the stock's premium valuation at 89 times trailing earnings and persistent concerns about capital efficiency continue to temper investor enthusiasm despite the operational improvement.

Read full news articleAre Triton Valves Ltd latest results good or bad?

2026-02-12 19:43:31Triton Valves Ltd's latest financial results for Q2 FY26 present a complex picture of operational performance. The company reported a revenue of ₹131.61 crores, reflecting an 11.11% year-on-year growth, although there was a sequential decline of 2.32% from the previous quarter. This indicates that while Triton Valves has managed to expand its revenue base significantly over the year, it faces challenges in maintaining momentum on a quarter-to-quarter basis. In terms of profitability, the net profit for the quarter stood at ₹1.94 crores, which represents a slight decline of 1.02% year-on-year. However, it did show a notable improvement of 25.97% compared to the previous quarter. Despite this quarterly gain, the overall profitability remains constrained, as evidenced by the operating margin, which decreased to 6.76% from 7.29% a year prior, indicating ongoing margin compression. The company's performance me...

Read full news article

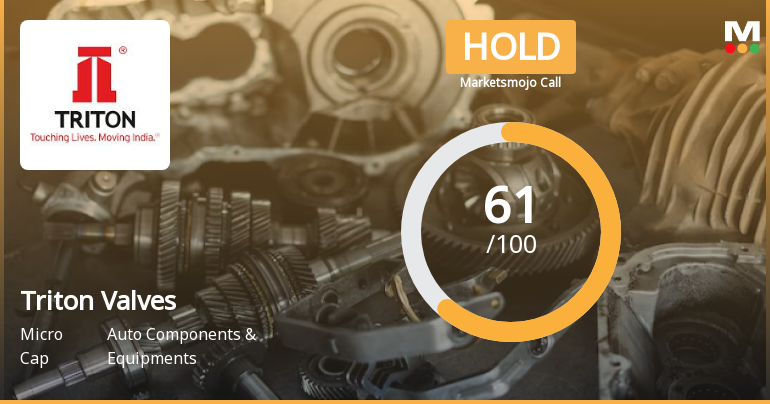

Triton Valves Ltd Upgraded to Hold as Technicals Improve and Valuation Adjusts

2026-02-06 08:08:39Triton Valves Ltd, a key player in the Auto Components & Equipments sector, has seen its investment rating upgraded from Sell to Hold as of 5 February 2026. This shift reflects a nuanced reassessment across four critical parameters: quality, valuation, financial trend, and technicals. Despite recent challenges, the company’s evolving technical indicators and fair valuation metrics have prompted a more balanced outlook, signalling cautious optimism among investors.

Read full news article