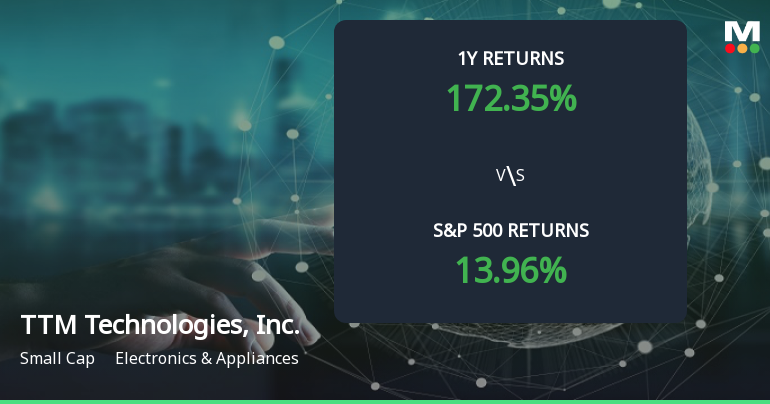

TTM Technologies Emerges as Multibagger Stock with 172.35% Return Over the Past Year

2025-11-12 15:26:29TTM Technologies, Inc. has recently undergone a revision in its score, reflecting its impressive market performance and financial metrics. The company has achieved significant growth, with notable increases in net profit and operational efficiency. Its strong institutional backing further solidifies its position in the Electronics & Appliances sector.

Read full news articleNo announcement available

Corporate Actions

No corporate action available