Recent Price Movement and Market Performance

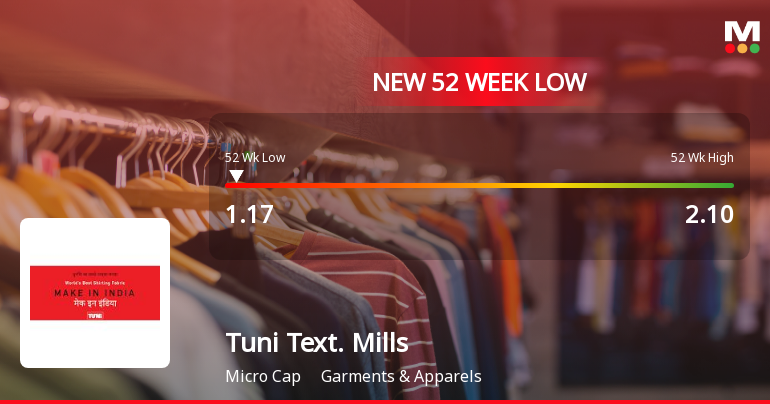

Tuni Textile Mills has been experiencing a challenging period, with the stock price falling consistently over the last eight trading sessions. During this stretch, the stock has lost approximately 17.79% in value, signalling persistent selling pressure. This recent decline is sharper than the sector’s performance, as the stock underperformed its peers by nearly 4.87% on the day of 17-Dec. Such underperformance highlights investor caution and a lack of confidence in the stock’s near-term prospects.

When compared to the benchmark Sensex, the stock’s performance appears even more concerning. Over the past week, while the Sensex managed a modest gain of 0.20%, Tuni Textile Mills declined by 10.67%. This divergence underscores th...

Read More