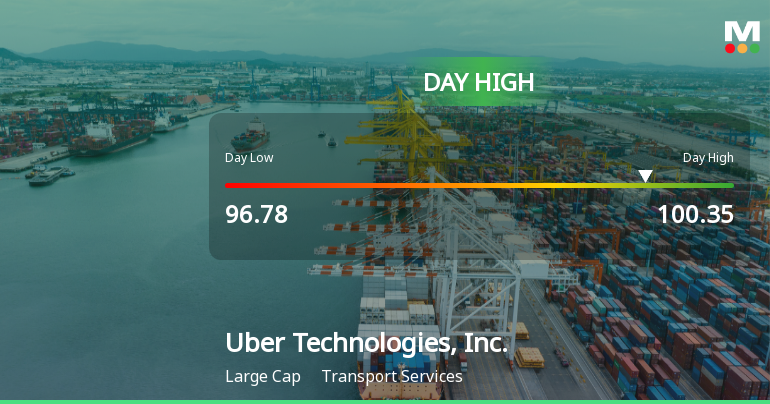

Uber Technologies Hits Day High with Strong 3.34% Intraday Surge

2025-11-04 18:30:42Uber Technologies, Inc. has shown significant growth, with a year-to-date increase of 65.32% and a 247.09% rise over three years. The company reported a 51.16% surge in operating profit and strong financial metrics, including an operating cash flow of USD 8,789 million and a high interest coverage ratio.

Read full news articleNo announcement available

Corporate Actions

No corporate action available