Key Events This Week

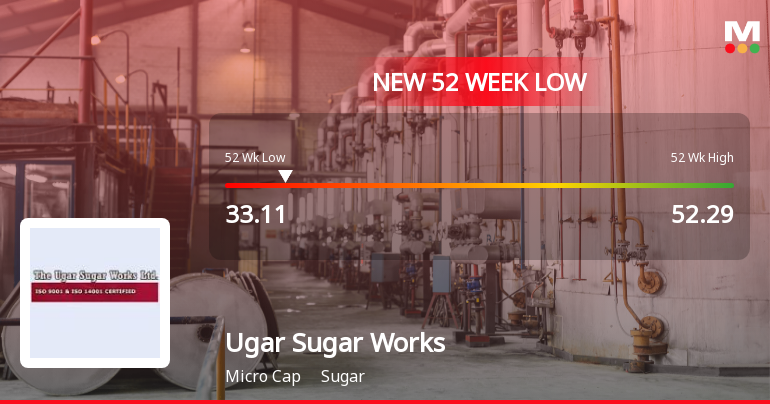

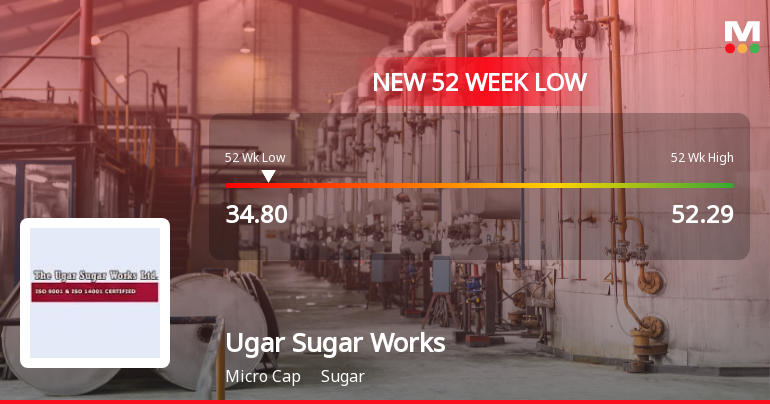

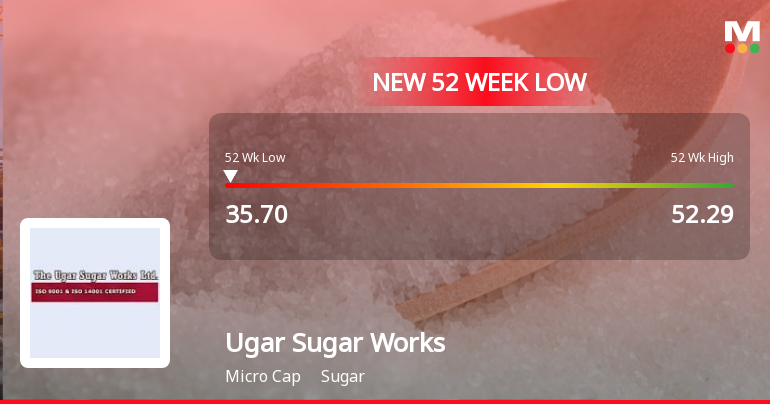

16 Feb: Week opens at Rs.36.97

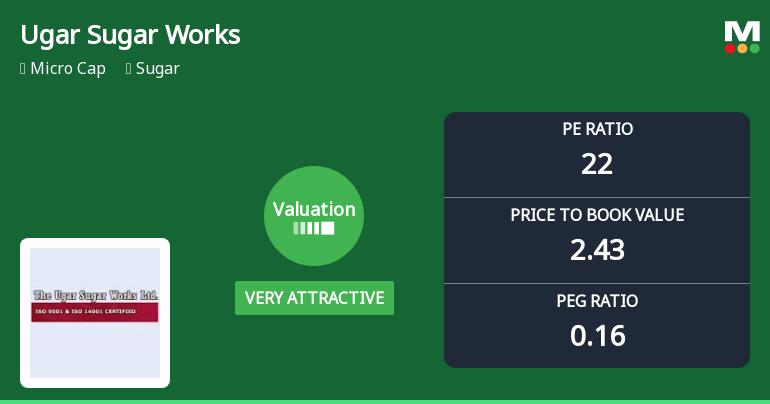

17 Feb: Upgrade to Sell rating by MarketsMOJO on improved financials and valuation

17 Feb: Valuation metrics upgraded to Very Attractive amid sector challenges

20 Feb: Week closes at Rs.35.97 (-2.70%) despite positive fundamentals

Ugar Sugar Works Ltd. Upgraded to Sell on Improved Financials and Valuation

2026-02-17 08:21:32Ugar Sugar Works Ltd. has seen its investment rating upgraded from Strong Sell to Sell as of 16 February 2026, reflecting a notable improvement in its financial trend and valuation metrics. Despite lingering concerns over debt levels and long-term growth, the company’s recent quarterly performance and attractive valuation multiples have prompted a reassessment of its outlook by analysts.

Read full news article

Ugar Sugar Works Ltd: Valuation Shifts Signal Renewed Price Attractiveness Amid Sector Challenges

2026-02-17 08:02:25Ugar Sugar Works Ltd has witnessed a notable shift in its valuation parameters, moving from an attractive to a very attractive rating, despite ongoing challenges reflected in its recent market performance. This recalibration in price-to-earnings and price-to-book value metrics offers investors a fresh perspective on the stock’s price attractiveness relative to its historical averages and peer group within the sugar sector.

Read full news article