Recent Price Movement and Market Context

Uniinfo Telecom's stock has shown a modest upward movement in the short term, with a one-week gain of 3.51%, outperforming the Sensex's 1.10% rise over the same period. Year-to-date, the stock has also advanced by 3.51%, surpassing the Sensex's 0.76% increase. However, this short-term strength contrasts sharply with the stock's longer-term performance, where it has declined by 52.94% over the past year and 27.50% over three years, significantly lagging the Sensex's respective gains of 8.85% and 44.68%.

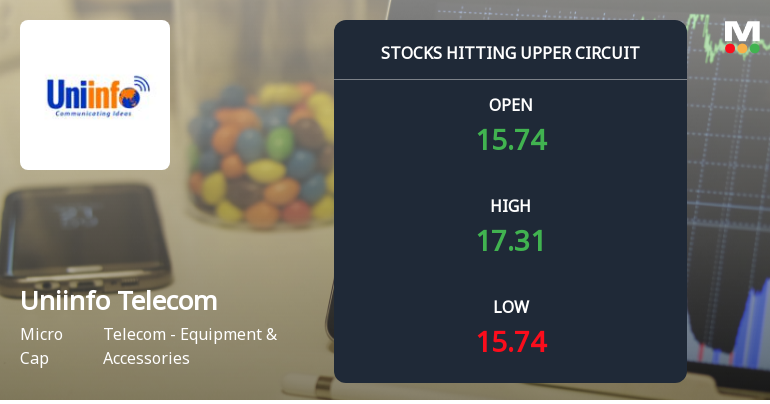

On the day in question, the stock outperformed its sector by 1.52%, trading above its 5-day and 20-day moving averages, signalling some positive momentum. Nevertheless, it remains below its 50-day, 100-day, and 200-day moving aver...

Read full news article