Valvoline, Inc. Experiences Revision in Its Stock Evaluation Amid Market Fluctuations

2025-11-24 15:36:12Valvoline, Inc., a small-cap company in the tour and travel services sector, has recently adjusted its valuation, with its stock price at $31.21. Despite a challenging year with a -19.06% return, Valvoline maintains strong financial metrics, including a high ROCE of 24.86% and an impressive ROE of 108.47%.

Read full news article

Valvoline Stock Plummets to New 52-Week Low of $29.29

2025-11-20 16:35:53Valvoline, Inc. has reached a new 52-week low, reflecting a notable decline over the past year. Despite this, the company maintains a strong market capitalization and demonstrates solid management efficiency, impressive operating cash flow, and significant net profit growth, indicating overall financial health amidst recent challenges.

Read full news article

Valvoline, Inc. Hits New 52-Week Low at $30.77 Amid Decline

2025-11-10 17:17:30Valvoline, Inc. has reached a new 52-week low, reflecting a notable decline in stock performance with a one-year return significantly lower than the S&P 500. Despite this, the company maintains a strong market capitalization, impressive management efficiency, and robust operating cash flow, while facing ongoing market challenges.

Read full news article

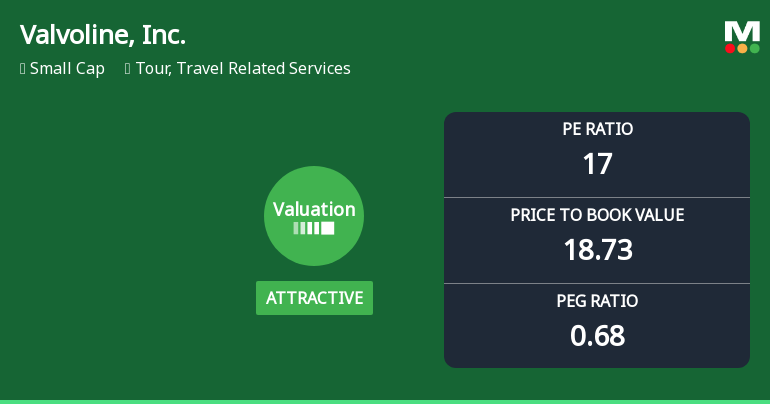

Valvoline, Inc. Experiences Revision in Its Stock Evaluation Amid Market Dynamics

2025-11-10 16:14:52Valvoline, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 17 and a price-to-book value of 18.73. The company boasts a strong return on capital employed of 24.86% and an impressive return on equity of 108.47%, highlighting its competitive position within the Tour and Travel Related Services industry.

Read full news article

Valvoline Stock Forms Death Cross, Signaling Potential Bearish Trend Ahead

2025-11-10 15:18:29Valvoline, Inc. has recently encountered a technical event known as a Death Cross, indicating a potential shift in market sentiment. Current indicators reflect a bearish outlook, with challenges in performance over the past year, significantly underperforming the S&P 500. Investors may need to watch for increased volatility.

Read full news article

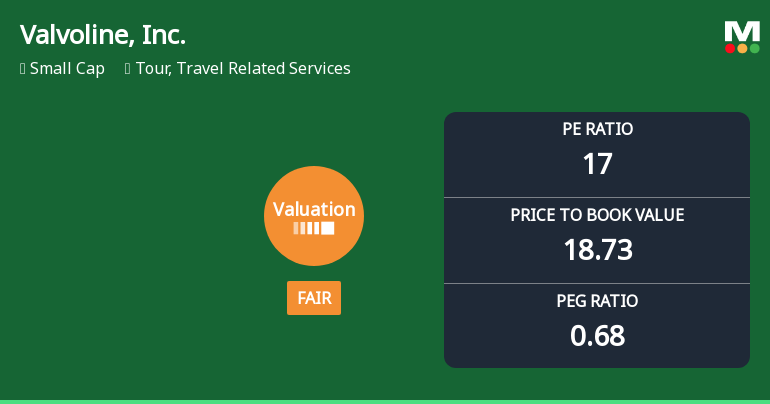

Valvoline, Inc. Experiences Revision in Its Stock Evaluation Amid Market Challenges

2025-10-27 16:08:52Valvoline, Inc. has recently adjusted its valuation, showing a P/E ratio of 17 and a low PEG ratio of 0.68, indicating potential value. The company boasts strong profitability metrics, including a ROCE of 24.86% and an ROE of 108.47%, but has struggled with stock performance compared to the S&P 500.

Read full news article