Varroc Engineering Exhibits Bullish Momentum Amid Technical Parameter Revision

2025-12-10 08:12:42Varroc Engineering, a key player in the Auto Components & Equipments sector, has demonstrated a notable shift in price momentum and technical indicators, reflecting a more optimistic market assessment. Recent evaluation adjustments highlight bullish signals across multiple timeframes, suggesting a potential strengthening in the stock’s trend.

Read More

Varroc Engineering Technical Momentum Shifts Amid Mixed Market Signals

2025-12-09 08:18:51Varroc Engineering, a key player in the Auto Components & Equipments sector, has experienced a nuanced shift in its technical momentum, reflecting a complex interplay of market forces and indicator signals. Recent data reveals a transition from a bullish to a mildly bullish trend, with mixed signals from key technical indicators such as MACD, RSI, and moving averages, suggesting a cautious outlook for investors navigating this stock.

Read More

Varroc Engineering Hits New 52-Week High at Rs.692 Marking Strong Market Momentum

2025-12-01 11:28:37Varroc Engineering has reached a significant milestone by touching a new 52-week high of Rs.692, reflecting notable momentum in the auto components sector amid a broadly positive market environment.

Read More

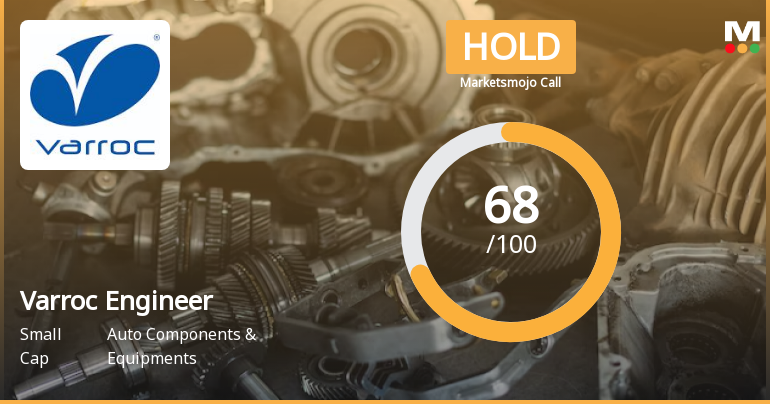

Varroc Engineer Sees Revision in Market Evaluation Amid Positive Financial Trends

2025-11-27 10:05:37Varroc Engineer, a small-cap player in the Auto Components & Equipments sector, has experienced a revision in its market evaluation reflecting recent shifts in its financial and technical outlook. This adjustment comes as the company demonstrates notable operational growth and a bullish technical stance, despite some challenges in debt servicing capacity.

Read More

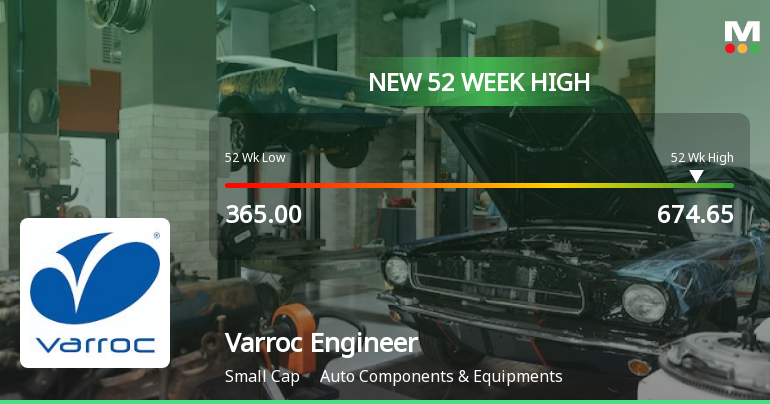

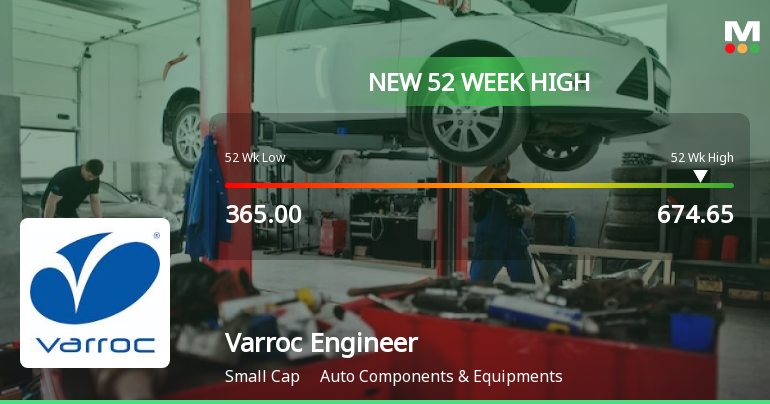

Varroc Engineering Hits New 52-Week High of Rs. 674.65

2025-11-14 12:14:39Varroc Engineering has achieved a new 52-week high, reflecting its strong performance in the auto components sector. The stock has consistently outperformed key moving averages and delivered significant returns over the past year, distinguishing itself within the small-cap segment amid a broader market downturn.

Read More

Varroc Engineering Hits New 52-Week High of Rs. 674.65

2025-11-14 12:14:39Varroc Engineering has achieved a new 52-week high, reflecting strong performance in the auto components industry. The stock has outperformed its sector and is trading above key moving averages. Over the past year, it has gained significantly, highlighting its resilience and growth amid broader market fluctuations.

Read More

Varroc Engineering Hits New 52-Week High of Rs. 670

2025-11-13 11:49:01Varroc Engineering has achieved a new 52-week high of Rs. 670, reflecting strong performance in the small-cap auto components sector. The stock has consistently outperformed its sector and is trading above key moving averages, while the broader market, represented by the Sensex, has also shown positive momentum.

Read More

Varroc Engineering Hits New 52-Week High at Rs. 670

2025-11-13 11:49:01Varroc Engineering has achieved a new 52-week high of Rs. 670, showcasing strong performance in the auto components sector. The stock has gained consistently over the last two days and is trading above key moving averages, reflecting a positive trend. Over the past year, it has significantly outperformed the Sensex.

Read MoreHow has been the historical performance of Varroc Engineer?

2025-11-13 00:34:51Answer: The historical performance of Varroc Engineer shows a fluctuating trend in net sales and profitability over the years, with a notable recovery in recent periods. Breakdown: Varroc Engineer's net sales increased from 6,891.21 Cr in March 2023 to 8,154.08 Cr in March 2025, reflecting a positive growth trend. However, this is a decline from the peak of 11,302.75 Cr in March 2021. The total operating income followed a similar pattern, rising to 8,154.08 Cr in March 2025 from 7,551.94 Cr in March 2024. The total expenditure also increased, reaching 7,365.33 Cr in March 2025, which is higher than the previous year's 6,778.37 Cr. Operating profit (PBDIT) showed improvement, increasing to 806.43 Cr in March 2025 from 801.15 Cr in March 2024, although it remains below the 1,179.70 Cr recorded in March 2019. Profit before tax decreased to 165.55 Cr in March 2025 from 270.46 Cr in March 2024, while profit aft...

Read MoreClosure of Trading Window

11-Dec-2025 | Source : BSETrading Window Closure for Q3 FY 2025-26

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

11-Dec-2025 | Source : BSEInvestor Call

Machine Readable Form / Legible Copy Of Financial Results As Per The Email Received From Stock Exchange

05-Dec-2025 | Source : BSEMachine Readable Financials

Corporate Actions

No Upcoming Board Meetings

Varroc Engineering Ltd has declared 100% dividend, ex-date: 08 Aug 25

No Splits history available

No Bonus history available

No Rights history available