Recent Price Movement and Market Context

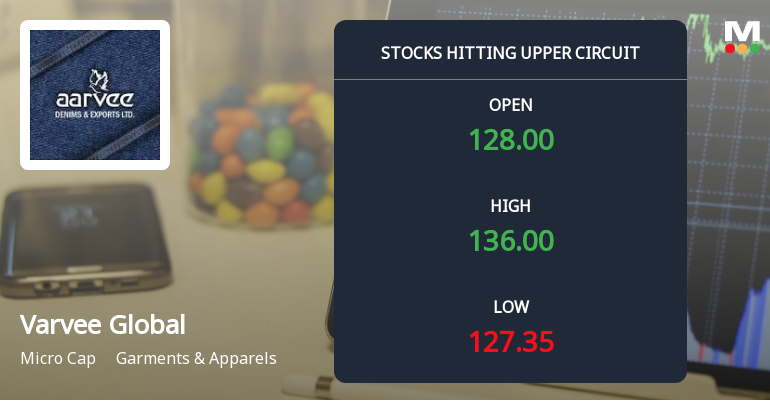

Varvee Global’s share price fell by ₹3.25 during the trading session on 27 February, touching an intraday low of ₹127, which represents a 3.61% dip from previous levels. The weighted average price for the day indicates that a larger volume of shares was traded closer to this low price, suggesting selling pressure dominated the session. This price action is further underscored by the stock trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, a technical indicator often interpreted as bearish momentum.

In comparison to the broader market, Varvee Global has underperformed significantly in the short term. Over the past week, the stock declined by 5.93%, whereas the Sensex fell by...

Read full news article