Veralto Corp. Adjusts Valuation Metrics, Reflecting Improved Financial Health and Market Position

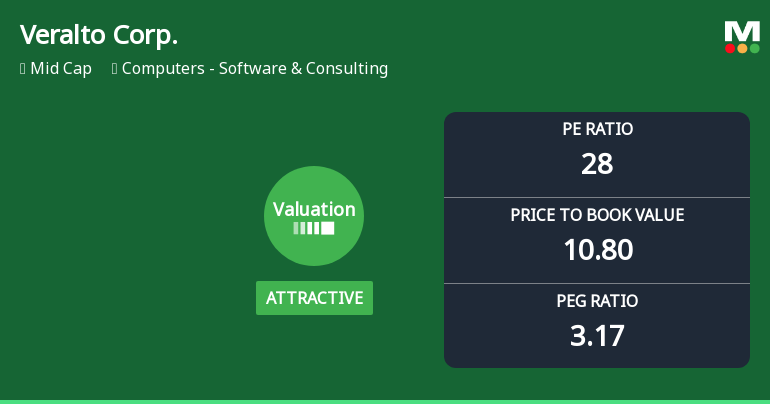

2025-10-23 15:55:41Veralto Corp. has recently experienced an evaluation adjustment, resulting in a more favorable valuation grade. Key financial metrics, including a Price-to-Earnings ratio of 28 and a return on equity of 37.97%, reflect the company's strong market position and effective capital utilization, despite a slight decline in stock returns.

Read MoreIs Veralto Corp. overvalued or undervalued?

2025-10-21 12:13:00As of 17 October 2025, the valuation grade for Veralto Corp. has moved from expensive to attractive, indicating a shift towards a more favorable assessment. The company appears to be undervalued, supported by its P/E ratio of 28, which is lower than the peer average of 29.71, and an EV to EBITDA ratio of 19.99, also below the peer average of 20.85. Additionally, Veralto's ROE stands at a robust 37.97%, highlighting strong profitability relative to equity. In comparison to its peers, Veralto Corp. shows a competitive edge with a PEG ratio of 3.17, suggesting that while growth is priced in, it remains reasonable compared to the industry. The stock has underperformed against the S&P 500 over the past year, with a return of -9.09% compared to the index's 14.08%, reinforcing the notion that the stock may be undervalued in the current market context....

Read More

Veralto Corp. Experiences Valuation Adjustment Amidst Competitive Market Dynamics

2025-10-20 17:47:42Veralto Corp., a midcap in the Computers - Software & Consulting sector, has adjusted its valuation, with a current price of $102.76. Despite a year-over-year stock return of -9.09%, the company boasts strong financial metrics, including a P/E ratio of 28 and a return on equity of 37.97%.

Read MoreIs Veralto Corp. overvalued or undervalued?

2025-10-20 12:30:15As of 17 October 2025, the valuation grade for Veralto Corp. has moved from expensive to attractive, indicating a shift towards a more favorable assessment. The company appears undervalued based on its current metrics. Key valuation ratios include a P/E ratio of 28, an EV to EBITDA of 19.99, and a PEG ratio of 3.17, which suggest that while the company has strong earnings growth potential, it is trading at a premium compared to its peers. In comparison to its peer, which has a P/E of 29.707 and an EV to EBITDA of 20.8457, Veralto Corp. presents a more attractive valuation. Additionally, its ROE of 37.97% and ROCE of 33.50% indicate strong profitability relative to its equity and capital employed. However, the recent stock performance shows that Veralto Corp. has underperformed against the S&P 500 over the past year, with a return of -9.09% compared to the index's 14.08%, reinforcing the notion that the sto...

Read MoreIs Veralto Corp. overvalued or undervalued?

2025-10-19 12:07:30As of 17 October 2025, the valuation grade for Veralto Corp. has moved from expensive to attractive, indicating a shift towards a more favorable assessment of the company's worth. Based on the current metrics, Veralto Corp. appears to be undervalued. The company has a P/E ratio of 28, a Price to Book Value of 10.80, and an EV to EBITDA of 19.99, which suggests that it is trading at a reasonable valuation compared to its earnings potential. In comparison to its peers, Veralto Corp. has a slightly lower P/E ratio than the industry average of 29.707, while its EV to EBITDA ratio is also competitive at 19.99 compared to the peer average of 20.8457. The company's strong ROCE of 33.50% and ROE of 37.97% further reinforce its attractiveness as an investment. However, recent stock performance shows that Veralto Corp. has underperformed the S&P 500 over the past year, with a return of -9.09% compared to the S&P 500...

Read MoreIs Veralto Corp. technically bullish or bearish?

2025-09-20 20:30:26As of 10 September 2025, the technical trend for Veralto Corp. has changed from mildly bullish to bullish. The weekly MACD is bullish, supporting the positive trend, while the daily moving averages also indicate bullish momentum. However, the weekly RSI is bearish, which suggests some caution. The Bollinger Bands show a mildly bullish stance on the weekly and a bullish stance on the monthly, indicating potential upward movement. The KST is bullish on the weekly, reinforcing the overall bullish sentiment. Despite the mixed signals from the OBV and Dow Theory, the prevailing indicators suggest a bullish stance overall. Multi-period return data is not available for comparison with the S&P 500....

Read MoreIs Veralto Corp. overvalued or undervalued?

2025-09-20 18:49:16As of 28 July 2025, Veralto Corp. has moved from fair to attractive in its valuation grade, indicating a more favorable outlook. The company appears to be undervalued, supported by a P/E ratio of 28, an EV to EBITDA of 19.99, and a PEG ratio of 3.17. In comparison, a peer such as Veralto Corp. has a higher P/E of 29.707 and a lower EV to EBITDA of 20.8457, suggesting that Veralto may offer better value relative to its peers. Despite recent performance, where Veralto's stock returned -0.95% over the past year compared to the S&P 500's 17.14%, the underlying valuation metrics suggest that the stock is positioned for potential upside. The strong ROCE of 33.50% and ROE of 37.97% further reinforce the attractiveness of Veralto Corp. as an investment opportunity....

Read More