Key Events This Week

2 Feb: Stock opens at Rs.19.88, declines 4.10%

3 Feb: Hits upper circuit at Rs.20.87 amid strong buying pressure

5 Feb: Reports flat quarterly performance with 148.2% PAT growth; stock rises 3.48%

6 Feb: Closes week at Rs.20.71, down 3.22% on the day

Are Virinchi Ltd latest results good or bad?

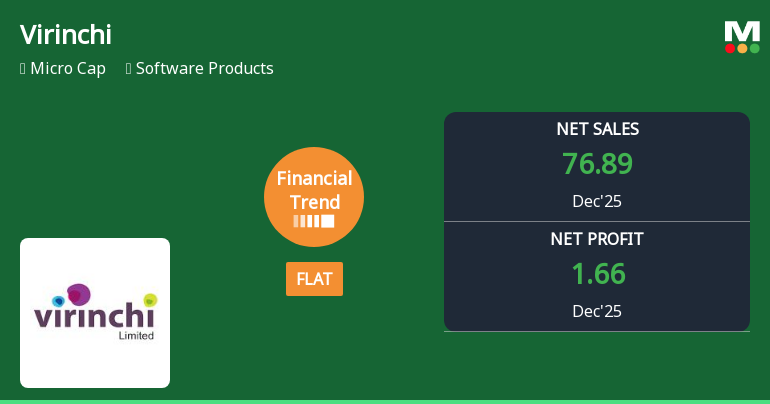

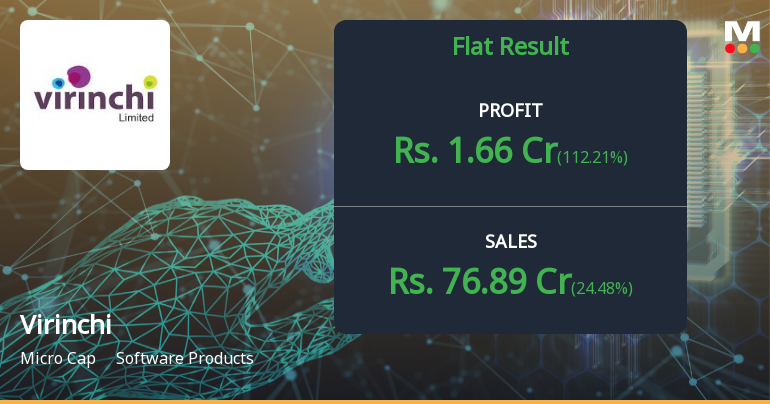

2026-02-05 19:24:46Virinchi Ltd's latest financial results for Q3 FY26 present a mixed picture. The company reported a net profit of ₹1.66 crore, marking a recovery from a significant loss in the previous quarter. This shift indicates a positive development in profitability, although the profit margin remains thin at 2.08%. Revenue for the quarter reached ₹76.89 crore, reflecting a quarter-on-quarter growth of 24.48%, which reverses a previous decline. However, year-on-year revenue shows a contraction of 6.69%, highlighting ongoing challenges in achieving consistent growth. The operating margin improved substantially to 33.35%, up from 17.11% in the prior quarter, suggesting better operational efficiency in the short term. Despite these sequential improvements, the year-on-year comparisons raise concerns. The decline in revenue and net profit compared to the same period last year indicates that Virinchi is grappling with s...

Read full news article

Virinchi Ltd Reports Flat Quarterly Performance Amid Mixed Financial Indicators

2026-02-05 11:00:19Virinchi Ltd, a player in the software products sector, has reported a flat financial performance for the quarter ended December 2025, signalling a pause in its previously negative trend. While certain profitability metrics have shown marked improvement, key efficiency and return ratios remain subdued, reflecting a complex financial landscape for the company.

Read full news article

Virinchi Ltd Q3 FY26: Profitability Returns Amid Revenue Volatility and Margin Pressures

2026-02-05 09:52:17Virinchi Ltd., a micro-cap software products company with a market capitalisation of ₹224.00 crores, returned to profitability in Q3 FY26 with a consolidated net profit of ₹1.66 crores, marking a sharp recovery from the previous quarter's loss of ₹13.60 crores. However, the quarter was characterised by persistent revenue volatility and margin compression, raising questions about the sustainability of this turnaround. The stock, trading at ₹21.25, has declined 26.70% over the past year, significantly underperforming the Sensex's 6.51% gain.

Read full news articleAre Virinchi Ltd latest results good or bad?

2026-02-04 19:20:23The latest financial results for Virinchi Ltd for Q2 FY26 highlight significant operational challenges and a marked deterioration in performance across key metrics. The company reported a net loss of ₹13.60 crore, a substantial decline from a profit in the previous quarter, indicating severe financial distress. Revenue also contracted sharply to ₹61.77 crore, reflecting a decline of 22.54% from the prior quarter and 16.83% year-on-year. This revenue drop suggests difficulties in maintaining the client base and securing new business in a competitive environment. Operating margins fell dramatically to 17.11%, down from 32.71% in the previous quarter, marking the lowest level in recent history. This compression in margins points to operational inefficiencies and challenges in cost management. Additionally, the return on equity has plummeted to a mere 0.15%, indicating that the company is generating virtually ...

Read full news article

Virinchi Ltd is Rated Strong Sell

2026-02-03 10:12:09Virinchi Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 30 December 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 03 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Virinchi Ltd Hits Upper Circuit Amid Strong Buying Pressure

2026-02-03 10:06:29Shares of Virinchi Ltd, a micro-cap player in the Software Products sector, surged to hit the upper circuit limit on 3 February 2026, reflecting robust buying interest despite the company’s recent strong sell rating. The stock closed at ₹20.87, marking a daily gain of 1.91%, driven by unrelenting demand and a regulatory freeze on further trading.

Read full news article

Virinchi Ltd Surges to Upper Circuit Amid Strong Buying Pressure

2026-01-28 14:00:10Shares of Virinchi Ltd, a micro-cap player in the Software Products sector, surged to hit the upper circuit limit on 28 Jan 2026, reflecting robust buying interest and a maximum daily gain of 5.00%. This price action underscores renewed investor confidence despite the company’s current Strong Sell mojo grade, signalling a complex market sentiment around the stock.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

06-Feb-2026 | Source : BSEplease find enclosed newspaper publication for quarterly results

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

06-Feb-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Vivo Bio Tech Ltd

Announcement under Regulation 30 (LODR)-Allotment

05-Feb-2026 | Source : BSEAllotment of 2070000 Equity Shares on conversion of Warrants issued on Preferential basis.

Corporate Actions

No Upcoming Board Meetings

Virinchi Ltd has declared 5% dividend, ex-date: 17 Sep 12

No Splits history available

Virinchi Ltd has announced 1:1 bonus issue, ex-date: 21 Mar 22

No Rights history available