Key Events This Week

2 Feb: Stock opens strong at ₹7,500.60 amid Sensex decline

3 Feb: Technical momentum shift noted with mixed indicators

5 Feb: Q3 FY26 results reveal 35% profit surge despite margin pressures

6 Feb: Flat financial trend reported despite record sales and profit

Are Voltamp Transformers Ltd latest results good or bad?

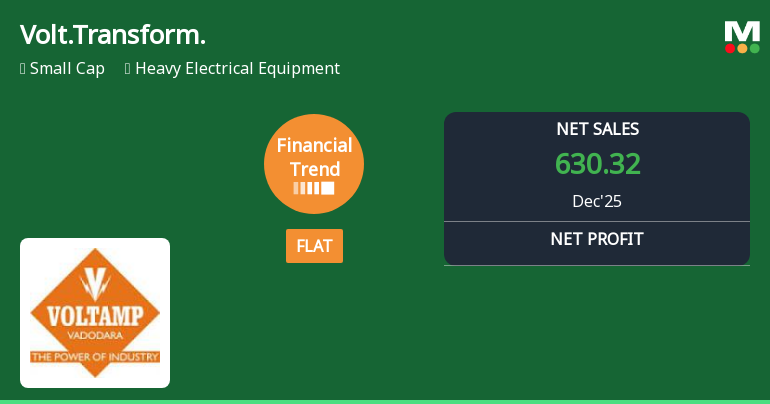

2026-02-06 19:28:19Voltamp Transformers Ltd's latest financial results for Q3 FY26 highlight a significant growth in both net sales and net profit, showcasing the company's operational strengths amid ongoing challenges. The net sales reached ₹630.32 crores, reflecting a year-on-year growth of 30.36% compared to ₹483.52 crores in the same quarter last year. This robust performance underscores the company's effective order execution and strong demand dynamics in the power transmission and distribution segments. Net profit for the quarter was reported at ₹99.08 crores, marking a year-on-year increase of 34.99%, which is a notable recovery from the previous year's decline. This growth in profitability suggests that the company has managed to leverage its operational capabilities effectively, despite facing pressures from rising raw material costs. However, the results also reveal a concerning trend in margin performance. The op...

Read full news article

Voltamp Transformers Ltd Reports Flat Quarterly Financial Trend Despite Record Sales and Profit

2026-02-06 08:00:26Voltamp Transformers Ltd, a key player in the Heavy Electrical Equipment sector, has reported a flat financial performance for the quarter ended December 2025, signalling a pause in its previously positive growth trajectory. Despite setting new records in net sales and profit after tax, the company’s return on capital employed has declined, raising concerns about margin sustainability and operational efficiency.

Read full news article

Voltamp Transformers Q3 FY26: Strong Quarter Drives 35% Profit Surge Despite Margin Compression

2026-02-05 17:48:13Voltamp Transformers Ltd., a prominent player in India's heavy electrical equipment sector, reported robust financial performance for Q3 FY26, with net profit surging 35.00% year-on-year to ₹99.08 crores from ₹73.40 crores in Q3 FY25. The Vadodara-based transformer manufacturer demonstrated strong revenue momentum, posting net sales of ₹630.32 crores—a 30.36% increase compared to the year-ago quarter and a sequential jump of 30.62% from Q2 FY26's ₹482.56 crores. Following the results announcement, the stock rallied 3.27% to close at ₹7,920.50 on February 5, 2026, though it remains 21.41% below its 52-week high of ₹10,078.75, reflecting investor concerns about margin pressures and premium valuations.

Read full news article

Voltamp Transformers Ltd Sees Technical Momentum Shift Amid Mixed Indicators

2026-02-03 08:03:48Voltamp Transformers Ltd has experienced a notable shift in price momentum, reflected in a complex interplay of technical indicators. While the stock has gained 2.69% on the day to ₹7,531, its technical trend has transitioned from bearish to mildly bearish, signalling a nuanced outlook for investors in the heavy electrical equipment sector.

Read full news article

Voltamp Transformers Ltd is Rated Hold by MarketsMOJO

2026-02-01 10:10:56Voltamp Transformers Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 08 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with an up-to-date view of the company's fundamentals, valuation, financial trends, and technical outlook.

Read full news articleWhen is the next results date for Voltamp Transformers Ltd?

2026-01-29 23:16:32The next results date for Voltamp Transformers Ltd is scheduled for February 5, 2026....

Read full news article

Voltamp Transformers Ltd is Rated Hold

2026-01-21 10:10:53Voltamp Transformers Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 08 Nov 2025. While the rating was revised on that date, the analysis and financial metrics discussed here reflect the stock's current position as of 21 January 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Voltamp Transformers Ltd is Rated Hold

2026-01-10 10:10:35Voltamp Transformers Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 08 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 10 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article