Warby Parker Experiences Revision in Its Stock Evaluation Amidst Challenging Market Conditions

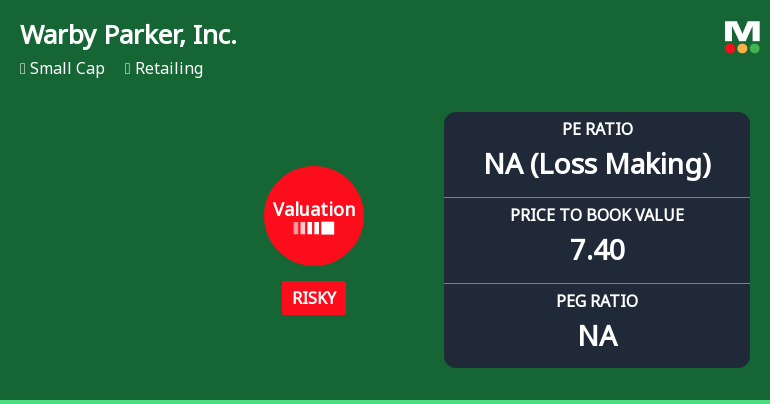

2025-11-10 16:21:47Warby Parker, Inc. has faced a valuation adjustment amid challenging financial metrics, including a high price-to-book value and an elevated EV to EBITDA ratio. The company's performance lags behind peers, with a significant decline in return metrics and a stark contrast in profitability indicators, highlighting ongoing market struggles.

Read full news articleNo announcement available

Corporate Actions

No corporate action available