Is Waters Corp. overvalued or undervalued?

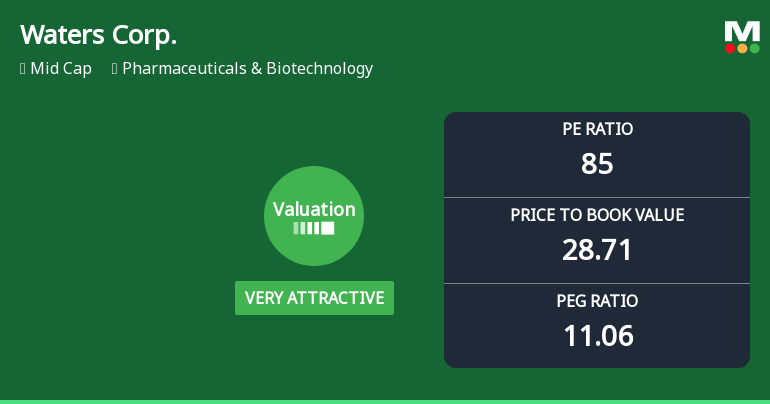

2025-10-21 11:59:00As of 17 October 2025, the valuation grade for Waters Corp. has moved from expensive to attractive, indicating a shift in perception regarding its value. The company appears to be undervalued, particularly in comparison to its peers. Key valuation ratios include a P/E ratio of 85, an EV to EBITDA of 54.96, and a PEG ratio of 11.06, which suggest that despite its high valuations, there may be growth potential that is not fully reflected in the current price. In the peer comparison, Waters Corp. has a P/E ratio significantly higher than ResMed, Inc. at 37.73 and Agilent Technologies, Inc. at 27.42, which are both in the same industry. Additionally, the EV to EBITDA ratio of 54.96 is higher than that of ResMed, which stands at 27.08, further emphasizing the relative valuation landscape. Over the past three years, Waters Corp. has returned 19.67%, while the S&P 500 has significantly outperformed with a return ...

Read More

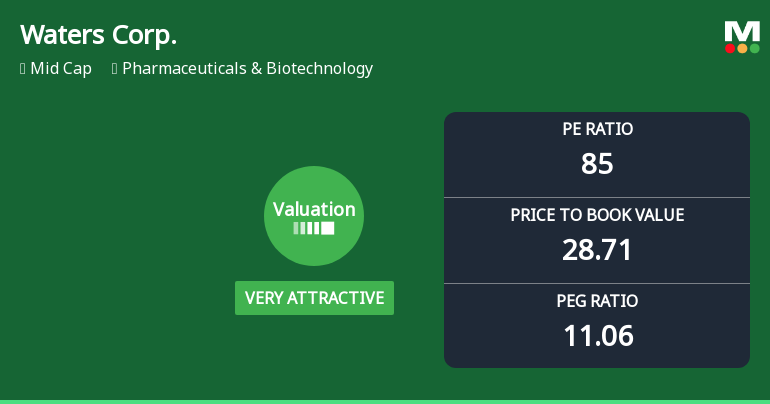

Waters Corp. Experiences Valuation Adjustment Amidst Competitive Pharmaceuticals Landscape

2025-10-20 17:08:23Waters Corp., a midcap in the Pharmaceuticals & Biotechnology sector, has adjusted its valuation, showcasing a P/E ratio of 85 and a price-to-book value of 28.71. The company reports strong performance metrics, including a ROCE of 27.82% and an ROE of 33.82%, amidst a competitive industry landscape.

Read MoreIs Waters Corp. overvalued or undervalued?

2025-10-19 11:54:44As of 17 October 2025, the valuation grade for Waters Corp. has moved from expensive to attractive, indicating a shift towards a more favorable assessment. The company appears to be undervalued based on its current metrics. Key ratios include a P/E ratio of 85, an EV to EBITDA of 54.96, and a PEG ratio of 11.06, which suggest that despite the attractive valuation grade, the company is still trading at a premium compared to its peers. In comparison to its peers, Waters Corp. has a P/E ratio significantly higher than ResMed, Inc. at 37.73 and Agilent Technologies, Inc. at 27.42, indicating that it may be overvalued relative to these companies. However, its EV to EBITDA ratio is better than Mettler-Toledo International, Inc., which stands at 47.45. Over the past year, Waters Corp. has underperformed against the S&P 500, with a return of -3.66% compared to the index's 14.08%, highlighting potential concerns re...

Read More

Waters Corp. Experiences Evaluation Revision Amid Mixed Market Signals and Performance Trends

2025-10-07 20:30:31Waters Corp., a midcap in the Pharmaceuticals & Biotechnology sector, has recently seen a stock price of $327.62, reflecting significant volatility over the past year. The company has experienced mixed technical indicators and varying performance compared to the S&P 500, highlighting its current market positioning.

Read More

Waters Corp. Experiences Valuation Adjustment Amidst Strong Profitability Metrics

2025-10-06 16:08:58Waters Corp., a midcap in the Pharmaceuticals & Biotechnology sector, has adjusted its valuation metrics, showing a premium compared to peers. With strong profitability indicators like a 27.82% ROCE and a 33.82% ROE, the company has faced a year-to-date decline, contrasting with broader market gains.

Read MoreIs Waters Corp. technically bullish or bearish?

2025-10-06 11:59:04As of 3 October 2025, the technical trend for Waters Corp. has changed from bearish to mildly bearish. The current stance is mildly bearish overall, driven by a mix of indicators. The weekly MACD is mildly bullish, while the monthly MACD is mildly bearish. The Bollinger Bands show a bullish signal on the weekly chart but are mildly bearish on the monthly. Moving averages indicate a mildly bearish trend on the daily timeframe. Dow Theory supports a mildly bullish outlook on both weekly and monthly timeframes. In terms of performance, Waters Corp. has outperformed the S&P 500 over the past week and month, with returns of 12.57% and 13.21% respectively, but has underperformed on a year-to-date and yearly basis, with returns of -11.48% and -7.34%. Over longer periods, the stock has lagged significantly behind the S&P 500....

Read MoreIs Waters Corp. technically bullish or bearish?

2025-10-05 11:43:54As of 3 October 2025, the technical trend for Waters Corp. has changed from bearish to mildly bearish. The current stance is mildly bearish overall, with key indicators showing mixed signals. The MACD is mildly bullish on a weekly basis but mildly bearish monthly, while the Bollinger Bands indicate a bullish weekly trend but a mildly bearish monthly trend. Moving averages are mildly bearish on a daily basis, and the KST is bearish on both weekly and monthly time frames. Dow Theory shows a mildly bullish stance on both weekly and monthly charts. In terms of performance, Waters Corp. has outperformed the S&P 500 over the past week and month, with returns of 12.57% and 13.21% respectively, but it has underperformed over the year-to-date and one-year periods. Overall, the technical indicators suggest caution despite some short-term bullish signals....

Read More

Waters Corp. Experiences Revision in Its Stock Evaluation Amidst High Valuation Metrics

2025-09-29 16:09:45Waters Corp., a midcap in the Pharmaceuticals & Biotechnology sector, has a high P/E ratio of 85 and strong performance metrics, including a ROCE of 27.82% and ROE of 33.82%. Despite its premium valuation, the company has underperformed compared to the S&P 500, with a year-to-date stock decline of 21.37%.

Read More