Strong Price Performance and Sector Influence

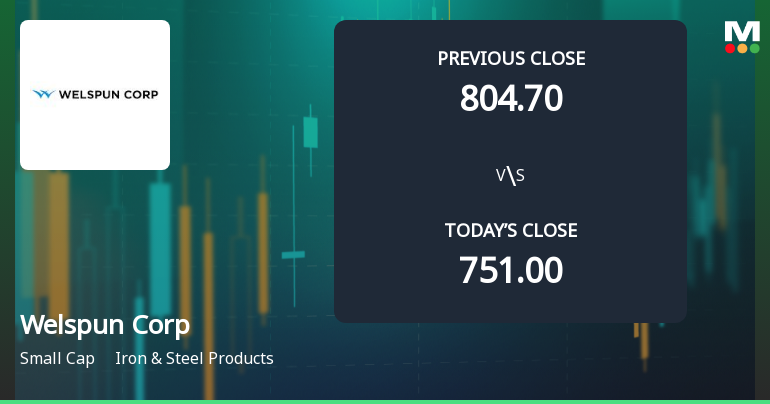

Welspun Corp Ltd. outperformed its sector and benchmark indices on 03-Feb, registering a notable gain of ₹55.30 or 7.36% by 08:29 PM. The stock opened with an impressive gap up of 8.75%, signalling strong buying interest from the outset. During the trading session, it reached an intraday high of ₹819, reflecting a 9.05% increase from the previous close. This surge is particularly remarkable given the steel, sponge iron, and pig iron sector itself gained 3% on the day, indicating that Welspun Corp’s rally was bolstered by positive sector momentum but also outpaced it significantly.

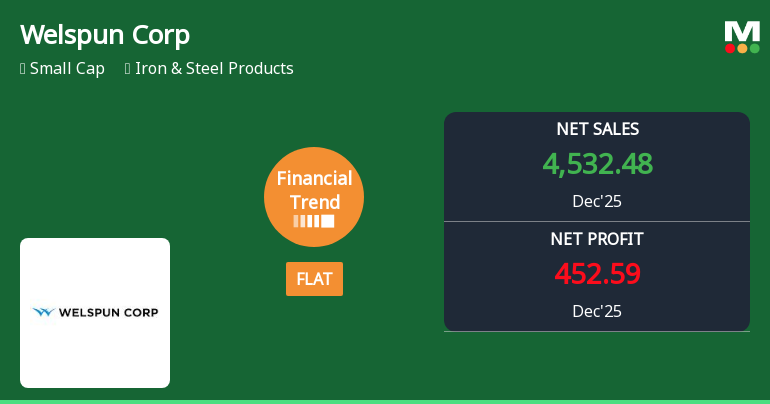

The stock has been on a three-day winning streak, accumulating a 10.61% return over this period, which further underscores growing investor confi...

Read full news article