Windlas Biotech Ltd Technical Momentum Shifts Amid Mixed Indicator Signals

2026-01-29 08:03:14Windlas Biotech Ltd has experienced a nuanced shift in its technical momentum, reflecting a complex interplay of bullish and bearish signals across multiple timeframes. Despite a recent upgrade from a Hold to a Sell rating by MarketsMOJO, the stock’s price action and key technical indicators suggest a cautious outlook for investors navigating the Pharmaceuticals & Biotechnology sector.

Read full news article

Windlas Biotech Ltd Faces Bearish Momentum Amid Technical Downgrade

2026-01-27 08:03:20Windlas Biotech Ltd has experienced a notable shift in its technical momentum, with key indicators signalling a transition from mildly bearish to a more pronounced bearish trend. The stock’s recent price action, combined with mixed signals from MACD, RSI, and moving averages, suggests increasing caution for investors amid a challenging market backdrop.

Read full news article

Windlas Biotech Ltd is Rated Sell

2026-01-22 10:10:58Windlas Biotech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 06 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 22 January 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

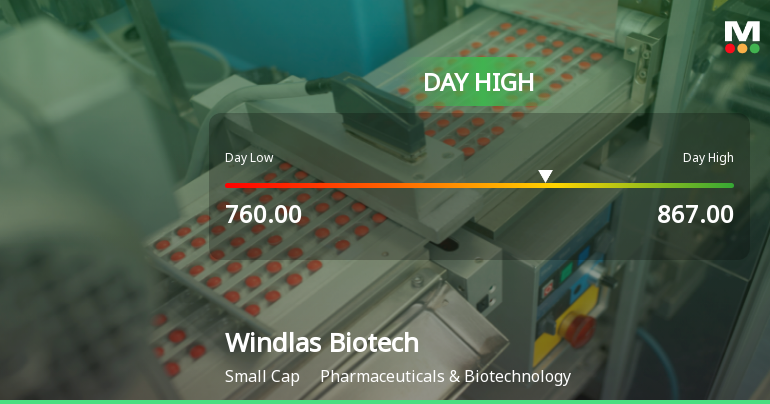

Windlas Biotech Ltd Hits Intraday High with 7.03% Surge on 14 Jan 2026

2026-01-14 15:46:19Windlas Biotech Ltd recorded a robust intraday performance on 14 Jan 2026, surging 7.03% to touch a day’s high of Rs 867, significantly outperforming the Pharmaceuticals & Biotechnology sector and broader market indices.

Read full news article

Windlas Biotech Ltd is Rated Sell

2026-01-11 10:10:27Windlas Biotech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 06 Nov 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 11 January 2026, providing investors with an up-to-date view of the company's performance and outlook.

Read full news article

Windlas Biotech Ltd is Rated Sell

2025-12-31 10:10:03Windlas Biotech Ltd is rated Sell by MarketsMOJO, with this rating last updated on 06 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 December 2025, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

Windlas Biotech Sees Revision in Market Evaluation Amidst Mixed Financial Signals

2025-12-20 10:10:25Windlas Biotech has experienced a revision in its market evaluation, reflecting a shift in analytical perspective driven by a combination of financial trends, valuation considerations, and technical indicators. This development comes amid a challenging year for the small-cap pharmaceutical and biotechnology company, which has seen its stock performance diverge notably from broader market indices.

Read full news article

Windlas Biotech Sees Revision in Market Assessment Amidst Challenging Performance

2025-11-29 17:52:31Windlas Biotech has undergone a revision in its market evaluation, reflecting shifts in key analytical parameters amid a backdrop of subdued stock performance and sector challenges. This adjustment highlights evolving perspectives on the company’s financial health, valuation, and technical outlook within the Pharmaceuticals & Biotechnology sector.

Read full news article

Windlas Biotech Faces Bearish Technical Trends Amidst Market Challenges

2025-11-13 08:10:53Windlas Biotech, a small-cap pharmaceutical company, has faced a challenging year with a return of -16.53%, contrasting with the Sensex's gain. Technical indicators suggest a bearish sentiment, yet the company has shown resilience with a notable 247.73% return over the past three years, outperforming the Sensex significantly.

Read full news articleCorporate Actions

05 Feb 2026

Windlas Biotech Ltd has declared 116% dividend, ex-date: 21 Jul 25

No Splits history available

No Bonus history available

No Rights history available