XPEL, Inc. Adjusts Evaluation Amid Strong Financial Performance and Emerging Concerns

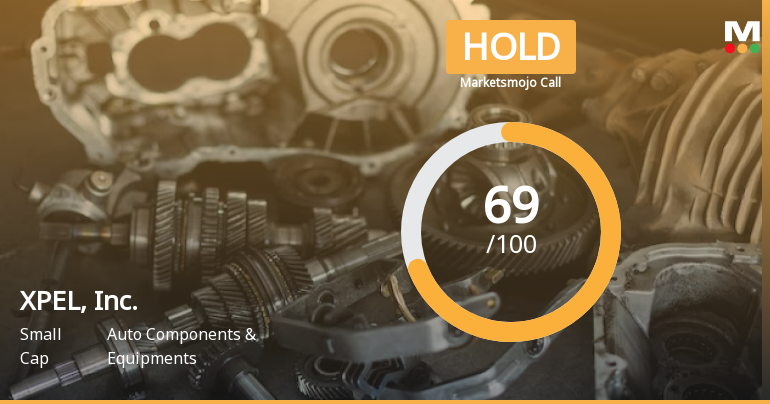

2025-11-11 16:35:32XPEL, Inc. has recently experienced a revision in its evaluation, influenced by various financial metrics. The company reported record net sales and operating cash flow, alongside a strong return on equity. However, some metrics indicate potential concerns, reflecting a complex view of its market position and operational performance.

Read full news articleNo announcement available

Corporate Actions

No corporate action available