Zim Laboratories Ltd Stock Hits 52-Week Low at Rs.64 Amidst Continued Downtrend

2026-03-13 10:05:26Zim Laboratories Ltd has touched a new 52-week low of Rs.64 today, marking a significant decline in its stock price amid a broader bearish trend in the Pharmaceuticals & Biotechnology sector. The stock has been under pressure for the past two days, falling by 4.42% during this period, and continues to trade below all key moving averages.

Read full news article

Zim Laboratories Ltd is Rated Strong Sell

2026-03-10 10:10:18Zim Laboratories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 08 August 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 10 March 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

Zim Laboratories Ltd is Rated Strong Sell

2026-02-27 10:10:17Zim Laboratories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 08 August 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 27 February 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Zim Laboratories Ltd is Rated Strong Sell

2026-02-16 10:10:24Zim Laboratories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 08 August 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 16 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news articleAre Zim Laboratories Ltd latest results good or bad?

2026-02-12 20:00:48Zim Laboratories Ltd's latest financial results for the third quarter of FY26 indicate a mixed performance characterized by some recovery in profitability and revenue growth, yet persistent operational challenges remain evident. The company reported a net profit of ₹4.40 crores, marking a turnaround from a loss in the previous quarter and a 10.00% increase year-on-year. Revenue also showed growth, rising to ₹108.66 crores, which reflects a 12.80% increase compared to the same quarter last year and a notable 22.49% increase from the previous quarter. Despite these positive indicators, the company's operating margin of 11.79% remains below the 12.00% achieved in the same quarter last year, highlighting ongoing cost pressures. The average return on equity (ROE) of 6.55% suggests challenges in capital efficiency, which is significantly lower than industry standards. Additionally, the company's nine-month perfo...

Read full news article

Zim Laboratories Q3 FY26: Recovery Masks Deeper Profitability Concerns

2026-02-12 09:53:09Zim Laboratories Ltd., a Nagpur-based pharmaceutical formulations manufacturer, reported a net profit of ₹4.40 crores for Q3 FY26 (October-December 2025), marking a dramatic turnaround from the ₹0.42 crore loss recorded in Q2 FY26. However, this sequential recovery, whilst impressive at first glance, reveals deeper structural concerns when viewed against year-on-year comparisons and margin pressures that continue to plague the ₹407 crore market capitalisation company.

Read full news articleAre Zim Laboratories Ltd latest results good or bad?

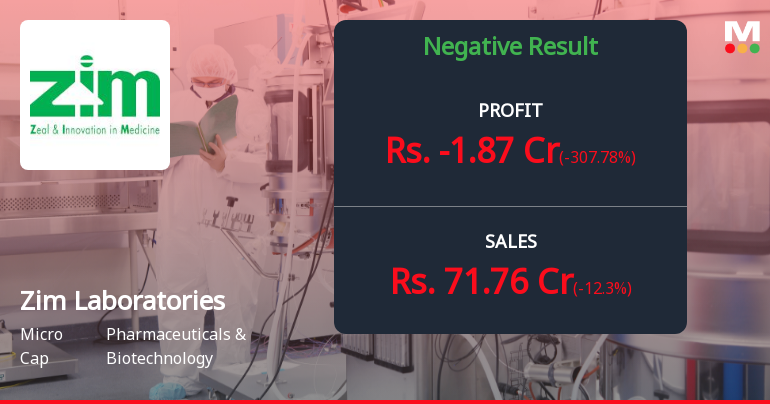

2026-02-11 19:50:39Zim Laboratories Ltd's latest financial results for Q2 FY26 present a mixed picture. The company reported a net loss of ₹0.42 crores, which reflects a significant decline in profitability compared to the profit of ₹2.38 crores in the same quarter last year, indicating ongoing operational challenges. This loss, while narrower than the ₹1.87 crores loss in the previous quarter, highlights the company's struggle to achieve sustainable profitability. On the revenue front, Zim Laboratories experienced a quarter-on-quarter increase in net sales, rising to ₹88.71 crores, which is a 23.62% improvement from the previous quarter. However, this figure represents a year-on-year decline of 3.72% from ₹92.14 crores in Q2 FY25, suggesting persistent top-line pressures in a competitive pharmaceutical environment. The operating margin, excluding other income, stood at 6.48%, showing a slight sequential improvement from 5....

Read full news articleWhen is the next results date for Zim Laboratories Ltd?

2026-02-06 23:19:05The next results date for Zim Laboratories Ltd is scheduled for 11 February 2026....

Read full news article

Zim Laboratories Ltd is Rated Strong Sell

2026-02-05 10:10:21Zim Laboratories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 08 August 2025. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 05 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news articleDisclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

23-Feb-2026 | Source : BSEWe hereby inform that the DMCC Authority has approved the closure (dissolution) of ZIM Laboratories Middle East DMCC step down subsidiary of the Company.

Announcement under Regulation 30 (LODR)-Credit Rating

17-Feb-2026 | Source : BSEPursaunt to Regulation 30 of SEBI (Listing Obligations and Disclsoure Requirements) Regulations 2015 please find attached the disclosure with respect to Credit Rating for your reference.

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

17-Feb-2026 | Source : BSETranscript of Q3 & 9MFY26 Earnings Conference Call

Corporate Actions

No Upcoming Board Meetings

Zim Laboratories Ltd has declared 5% dividend, ex-date: 19 Sep 19

No Splits history available

Zim Laboratories Ltd has announced 2:1 bonus issue, ex-date: 22 Dec 22

No Rights history available