Compare Nivaka Fashions with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.34

- The company has been able to generate a Return on Equity (avg) of 1.81% signifying low profitability per unit of shareholders funds

Flat results in Dec 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Garments & Apparels

INR 20 Cr (Micro Cap)

NA (Loss Making)

26

0.00%

0.19

-15.96%

2.29

Total Returns (Price + Dividend)

Nivaka Fashions for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

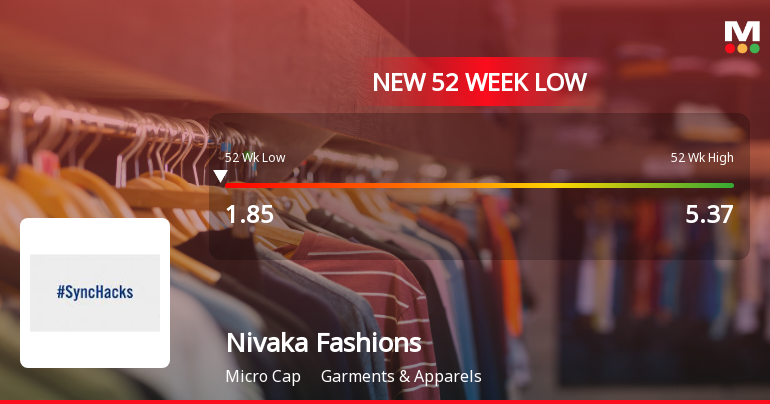

Nivaka Fashions Ltd Stock Falls to 52-Week Low of Rs.1.81 Amid Continued Downtrend

Nivaka Fashions Ltd, a player in the Garments & Apparels sector, has touched a new 52-week and all-time low of Rs.1.81 on 13 Feb 2026, marking a significant decline in its stock price amid broader market pressures and company-specific performance issues.

Read full news article

Nivaka Fashions Ltd Stock Hits All-Time Low Amid Prolonged Downtrend

Nivaka Fashions Ltd, a player in the Garments & Apparels sector, has reached an all-time low in its stock price, reflecting a sustained period of decline. The stock closed just 2.63% above its 52-week low of ₹1.85, underscoring the severity of its recent performance relative to broader market indices and sector peers.

Read full news articleAre Nivaka Fashions Ltd latest results good or bad?

Nivaka Fashions Ltd's latest financial results for Q2 FY26 indicate significant operational challenges. The company reported net sales of ₹0.00 crore, marking a complete cessation of revenue generation compared to ₹0.01 crore in the previous quarter and a decline from ₹0.05 crore in Q2 FY25. This trend highlights a troubling trajectory of revenue erosion over several quarters, with the latest quarter reflecting a severe operational crisis. The net loss for Q2 FY26 was ₹0.59 crore, which is a deterioration from the loss of ₹0.48 crore in Q1 FY26. This indicates a widening of losses as the company continues to incur substantial operational costs, including employee expenses that rose to ₹0.18 crore. The operating profit (PBDIT) also worsened, showing a negative figure of ₹0.40 crore, further compounding the financial difficulties faced by the company. Profitability metrics reveal a return on equity (ROE) of...

Read full news article Announcements

Board Meeting Intimation for Board Meeting Intimation Scheduled To Be Held On Wednesday 11Th February 2026.

06-Feb-2026 | Source : BSENivaka Fashions Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/02/2026 inter alia to consider and approve Board meeting intimation scheduled to be held on Wednesday 11th February 2026.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

14-Jan-2026 | Source : BSECertificate under Reg 74(5) of the SEBI(DP)Regulation 2018

Closure of Trading Window

29-Dec-2025 | Source : BSEIntimation of closure of trading window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Nivaka Fashions Ltd has announced 4:5 bonus issue, ex-date: 24 Jun 19

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 1 FIIs (4.77%)

Priyesh Shantilal Jain (14.0%)

Dulerai Prabhashankar Sompura (5.26%)

44.97%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 0.00% vs -100.00% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 10.17% vs -22.92% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -91.67% vs -88.12% in Sep 2024

Growth in half year ended Sep 2025 is -98.15% vs -1,000.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -88.24% vs -84.55% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -116.22% vs -196.00% in Dec 2024