Compare Norben Tea with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -6.10% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 6.85 times

- The company has been able to generate a Return on Equity (avg) of 0.72% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

With ROCE of 0.9, it has a Very Expensive valuation with a 4.9 Enterprise value to Capital Employed

Total Returns (Price + Dividend)

Norben Tea for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

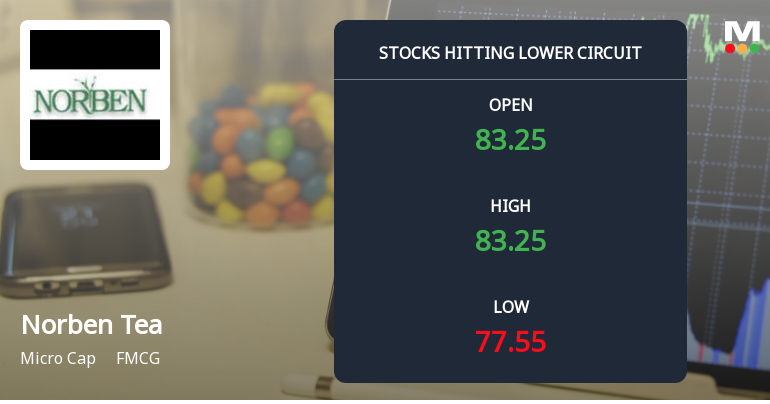

Norben Tea & Exports Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Shares of Norben Tea & Exports Ltd, a micro-cap player in the FMCG sector, plunged to their lower circuit limit on 9 Feb 2026, closing at ₹80.00 after a sharp intraday fall of 2.0%. The stock faced intense selling pressure, with volumes drying up and a significant drop in investor participation, signalling panic selling and unfilled supply at lower price levels.

Read full news article

Norben Tea & Exports Ltd is Rated Sell

Norben Tea & Exports Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 23 June 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 08 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Norben Tea & Exports Ltd is Rated Sell

Norben Tea & Exports Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 23 June 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 28 January 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Board Meeting Intimation for Considering And Approving The Unaudited Financial Results Of The Company For The Quarter And Nine Months Ended On 31St December 2025.

06-Feb-2026 | Source : BSENorben Tea & Exports Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve the Un-audited Financial Results (Standalone and Consolidated) of the Company for the quarter and nine months ended 31 December 2025 and to transact any other business with the permission of the Chairman.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

10-Jan-2026 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the Quarter ended 31.12.2025

Closure of Trading Window

26-Dec-2025 | Source : BSENorben Tea & Exports Limited has informed the Exchange regarding the trading window closure pursuant to SEBI(Prohibition of Insider Trading) Regulations 2015.

Corporate Actions

13 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 3 Schemes (0.09%)

Held by 0 FIIs

Tongani Tea Company Ltd (14.54%)

Kailash Dhanuka Huf (4.99%)

49.86%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 94.31% vs 13.89% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -62.07% vs 128.16% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -20.44% vs 14.04% in Sep 2024

Growth in half year ended Sep 2025 is -60.00% vs 25.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 21.89% vs -23.33% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 226.87% vs -197.10% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 16.26% vs -15.42% in Mar 2024

YoY Growth in year ended Mar 2025 is 89.41% vs -909.52% in Mar 2024