Compare Orosil Smiths with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate 0.20% of over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.35

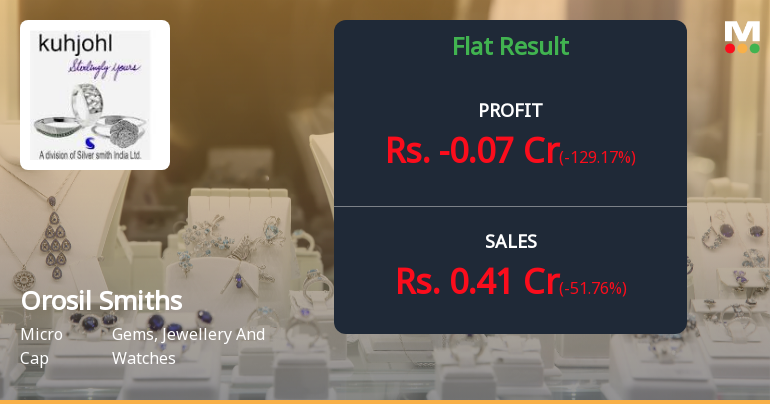

Flat results in Dec 25

Risky - Negative EBITDA

Stock DNA

Gems, Jewellery And Watches

INR 19 Cr (Micro Cap)

18.00

54

0.00%

-0.20

40.40%

7.29

Total Returns (Price + Dividend)

Orosil Smiths for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Orosil Smiths India Ltd latest results good or bad?

Orosil Smiths India Ltd's latest financial results for Q2 FY26 present a complex picture of operational performance. The company reported a net profit of ₹0.24 crores, marking a significant turnaround from a loss of ₹0.10 crores in the same quarter last year. Revenue for the quarter surged to ₹0.85 crores, reflecting a remarkable year-on-year growth of 1316.67%. The profit after tax (PAT) margin stood at 28.24%, a notable improvement from the previous year's deeply negative margin. However, a closer examination reveals some underlying concerns. The revenue showed a sequential decline of 3.41% from ₹0.88 crores in the previous quarter (Q1 FY26), indicating potential volatility in sales. Furthermore, the company's reliance on other income, which contributed significantly to the net profit, raises questions about the sustainability of this profitability. The operating profit before depreciation, interest, and...

Read full news article

Orosil Smiths India Q2 FY26: Profitability Returns Amid Revenue Surge, But Sustainability Questions Linger

Orosil Smiths India Ltd., a micro-cap jewellery manufacturer with a market capitalisation of ₹18.00 crores, reported a sharp return to profitability in Q2 FY26 with net profit of ₹0.24 crores, reversing a year-ago loss of ₹0.10 crores. The company's shares closed at ₹4.43 on February 06, 2026, up 2.55% on the day, though the stock remains 22.96% below its 52-week high of ₹5.75, reflecting investor caution about the sustainability of this turnaround.

Read full news articleAre Orosil Smiths India Ltd latest results good or bad?

Orosil Smiths India Ltd's latest financial results for Q2 FY26 reveal a complex operational landscape. The company reported net sales of ₹0.85 crores, which reflects a significant year-on-year growth of 1316.67% from a very low base of ₹0.06 crores in Q2 FY25. However, this figure represents a quarter-on-quarter decline of 3.41% from ₹0.88 crores in Q1 FY26, indicating a loss of momentum in sales. The net profit for the quarter was ₹0.24 crores, marking a substantial increase of 700% compared to the previous quarter's profit of ₹0.03 crores. This increase, while notable, raises concerns as it is heavily reliant on other income, which contributed ₹0.27 crores. The operating profit, excluding other income, was effectively zero, highlighting ongoing challenges in the core jewellery manufacturing operations. The reported PAT margin of 28.24% appears strong but is primarily driven by non-operational income, ra...

Read full news article Announcements

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

10-Feb-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for B K Narula HUF

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

10-Feb-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for B K Narula HUF

Announcement under Regulation 30 (LODR)-Newspaper Publication

07-Feb-2026 | Source : BSEPlease find enclosed

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Orosil Smiths India Ltd has announced 1:5 stock split, ex-date: 24 Aug 17

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

B.k.narula (17.26%)

Nam Securities Limited (5.3%)

23.54%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -51.76% vs -3.41% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -129.17% vs 700.00% in Sep 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 462.00% vs -32.43% in Mar 2024

YoY Growth in year ended Mar 2025 is 248.78% vs -17.14% in Mar 2024