Compare Panache Digilife with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 8.10%

- Poor long term growth as Operating profit has grown by an annual rate 12.76% of over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.78 times

With a growth in Net Sales of 257.86%, the company declared Outstanding results in Dec 25

With ROCE of 11, it has a Expensive valuation with a 5.8 Enterprise value to Capital Employed

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 0.2 per share ex-dividend date: Sep-21-2020

Risk Adjusted Returns v/s

Returns Beta

News

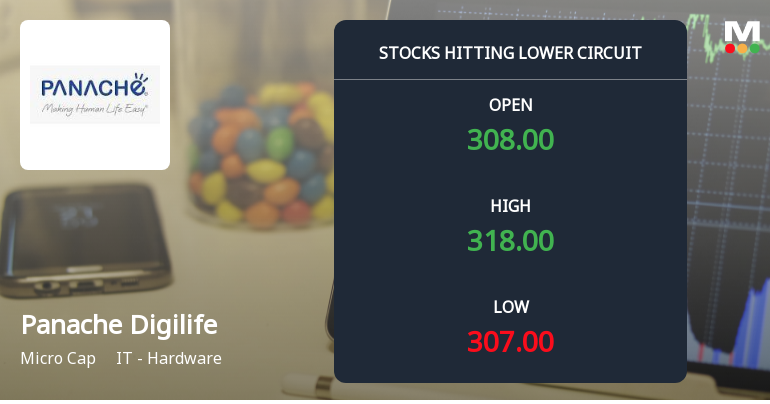

Panache Digilife Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Shares of Panache Digilife Ltd, a micro-cap player in the IT - Hardware sector, plunged to their lower circuit limit on 4 March 2026, closing at ₹307.2 after a sharp intraday fall. The stock witnessed intense selling pressure, culminating in a maximum daily loss of 4.94%, significantly underperforming both its sector and the broader market indices.

Read full news article

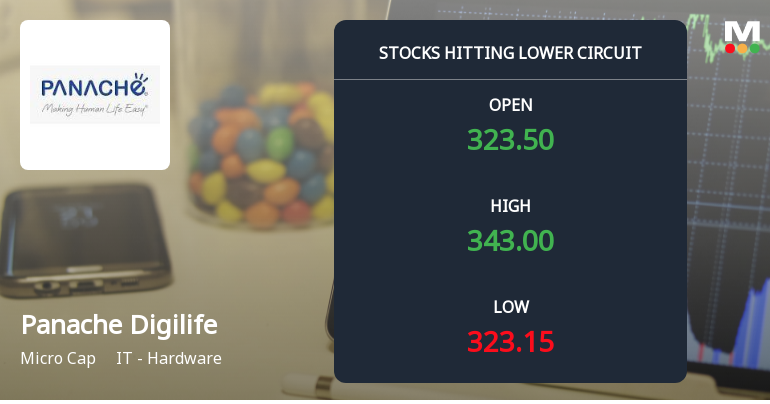

Panache Digilife Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Shares of Panache Digilife Ltd, a micro-cap player in the IT - Hardware sector, plunged to their lower circuit limit on 2 Mar 2026, closing at ₹323.15, down 5.0% from the previous close. The stock witnessed intense selling pressure, with unfilled supply and panic selling dominating trade, marking its maximum daily loss in recent sessions and underperforming both its sector and the broader market indices.

Read full news article

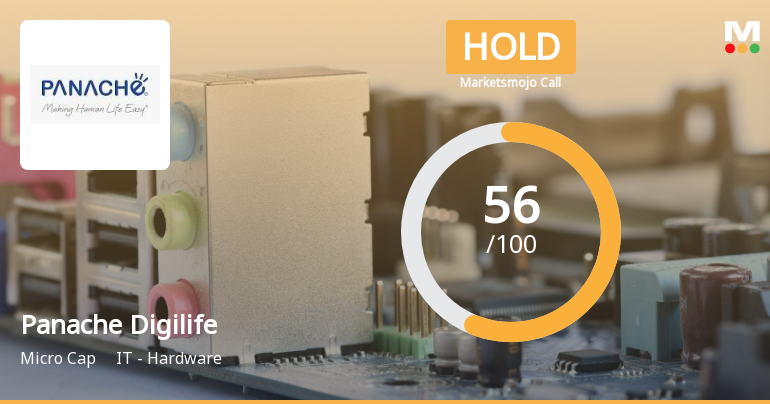

Panache Digilife Ltd is Rated Hold

Panache Digilife Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 February 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

Panache Digilife Ltd has declared 2% dividend, ex-date: 21 Sep 20

No Splits history available

Panache Digilife Ltd has announced 1:1 bonus issue, ex-date: 18 Jul 19

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Jan 2026

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Nikit D Rambhia (19.94%)

Deepak Meghji Savla (4.49%)

34.14%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 257.86% vs 36.82% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 120.20% vs 253.57% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 94.78% vs 32.66% in Sep 2024

Growth in half year ended Sep 2025 is -14.02% vs 1,220.00% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 155.35% vs 34.17% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 43.51% vs 507.89% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 20.27% vs -13.65% in Mar 2024

YoY Growth in year ended Mar 2025 is 1,152.73% vs -32.93% in Mar 2024