Compare Plastiblends (I) with Similar Stocks

Stock DNA

Specialty Chemicals

INR 404 Cr (Micro Cap)

12.00

38

1.57%

-0.02

7.44%

0.95

Total Returns (Price + Dividend)

Latest dividend: 2.5 per share ex-dividend date: Jul-08-2025

Risk Adjusted Returns v/s

Returns Beta

News

Plastiblends India Ltd is Rated Strong Sell

Plastiblends India Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 12 January 2026. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 04 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

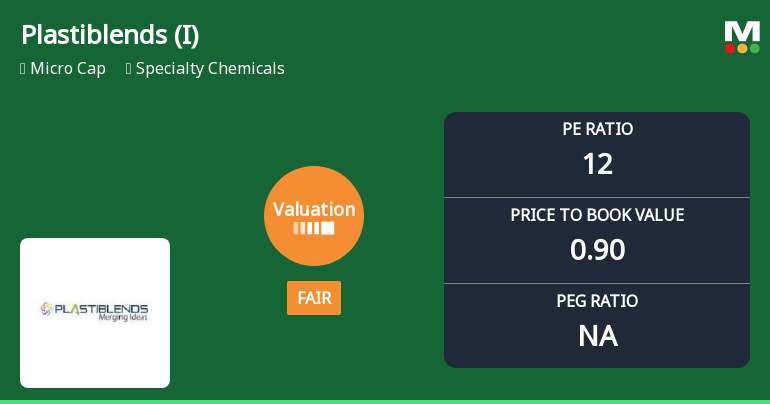

Plastiblends India Ltd Valuation Shifts to Fair Amidst Market Challenges

Plastiblends India Ltd, a key player in the Specialty Chemicals sector, has seen its valuation parameters shift from attractive to fair, signalling a notable change in price attractiveness. With a current P/E ratio of 12.03 and a Price to Book Value of 0.90, the stock’s valuation now aligns more closely with sector averages, prompting a reassessment of its investment appeal amid a challenging market backdrop.

Read full news article

Plastiblends India Ltd Falls to 52-Week Low of Rs.145.55

Plastiblends India Ltd’s share price declined to a fresh 52-week low of Rs.145.55 on 28 Jan 2026, marking a significant downturn amid broader market gains. The stock underperformed its sector and key benchmarks, reflecting ongoing pressures on the company’s financial performance and valuation metrics.

Read full news article Announcements

Board Meeting Outcome for Un-Audited Financial Results For The Quarter And Nine Months Ended December 31 2025

14-Jan-2026 | Source : BSEOutcome of Board Meeting - Un -audited Financial Results for

Board Meeting Intimation for Quarterly Results Preponed

07-Jan-2026 | Source : BSEPlastiblends India Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 14/01/2026 inter alia to consider and approve Un-audited Financial Results for the quarter and nine months ended December 31 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECertificate under Reg 74 (5) of SEBI (DP) Regulations

Corporate Actions

No Upcoming Board Meetings

Plastiblends India Ltd has declared 50% dividend, ex-date: 08 Jul 25

Plastiblends India Ltd has announced 5:10 stock split, ex-date: 29 Feb 12

Plastiblends India Ltd has announced 1:1 bonus issue, ex-date: 03 Jul 17

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 5 FIIs (0.24%)

Varun Satyanarayan Kabra (0.29%)

Colloids (widnes) Ltd Pension Fund (0.018%)

29.41%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -3.54% vs -3.52% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -13.04% vs -16.59% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -1.18% vs -2.27% in Sep 2024

Growth in half year ended Sep 2025 is -4.66% vs -0.12% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -0.56% vs -3.64% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -4.36% vs 0.34% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -2.71% vs 4.38% in Mar 2024

YoY Growth in year ended Mar 2025 is -3.16% vs 28.60% in Mar 2024