Compare Post Holdings, Inc. with Similar Stocks

Total Returns (Price + Dividend)

Post Holdings, Inc. for the last several years.

Risk Adjusted Returns v/s

News

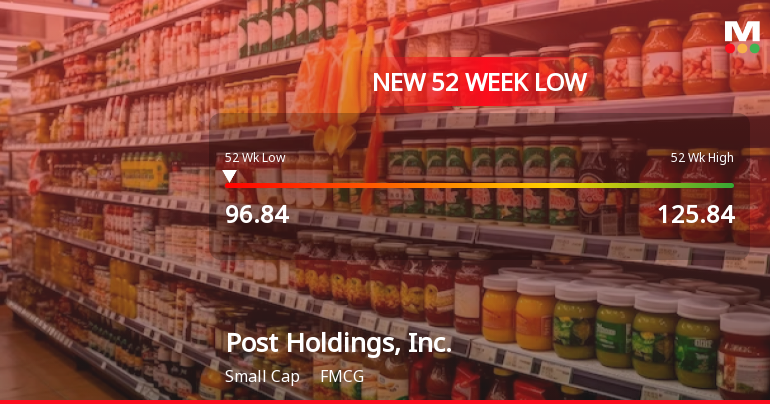

Post Holdings, Inc. Hits New 52-Week Low at $96.84

Post Holdings, Inc. has reached a new 52-week low, reflecting a notable decline in its stock price over the past year. The company, with a market capitalization of USD 8,114 million, faces challenges such as a high debt-to-equity ratio and stagnant operating profit growth, while lacking a dividend yield.

Read full news article

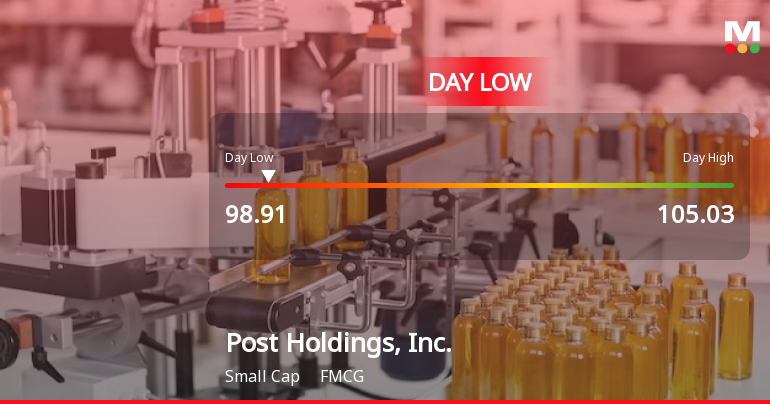

Post Holdings Stock Hits Day Low of $98.91 Amid Price Pressure

Post Holdings, Inc. faced a notable stock decline, reaching an intraday low amid ongoing performance challenges. The company has seen significant decreases over various time frames, including annual and year-to-date metrics. Financially, it exhibits a high debt-equity ratio and offers no dividend yield, reflecting a complex market position.

Read full news article

Post Holdings, Inc. Hits New 52-Week Low at $98.91

Post Holdings, Inc. has reached a new 52-week low, reflecting a notable decline in its stock price over the past year. The company, with a market capitalization of USD 8,114 million, faces challenges such as a high debt-to-equity ratio and a slight decrease in profitability. Institutional holdings remain at 100%.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 94 Schemes (42.44%)

Held by 160 Foreign Institutions (14.37%)

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 13.24% vs 1.65% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -52.99% vs 73.64% in Jun 2025

Annual Results Snapshot (Consolidated) - Sep'25

YoY Growth in year ended Sep 2025 is 2.97% vs 13.33% in Sep 2024

YoY Growth in year ended Sep 2025 is -8.48% vs 17.26% in Sep 2024