Compare Prajay Engineers with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -16.76

- The company has been able to generate a Return on Equity (avg) of 0.01% signifying low profitability per unit of shareholders funds

Negative results in Sep 25

Risky - Negative EBITDA

Underperformed the market in the last 1 year

Stock DNA

Realty

INR 162 Cr (Micro Cap)

NA (Loss Making)

35

0.00%

0.24

-5.54%

0.32

Total Returns (Price + Dividend)

Latest dividend: 2.5 per share ex-dividend date: Sep-18-2008

Risk Adjusted Returns v/s

Returns Beta

News

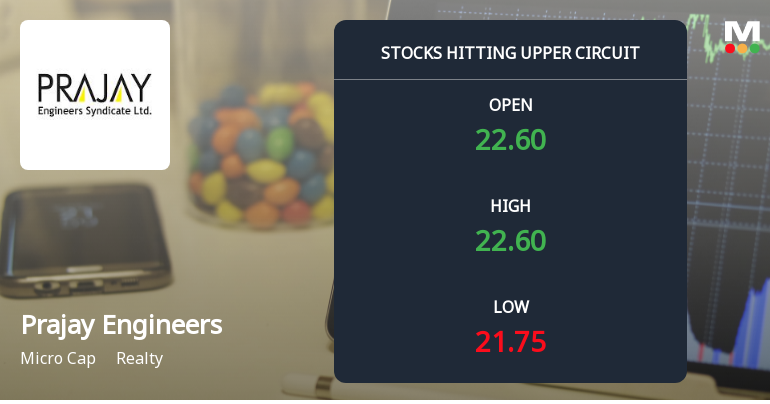

Prajay Engineers Syndicate Ltd Hits Upper Circuit Amid Strong Buying Pressure

Shares of PraJay Engineers Syndicate Ltd surged to hit the upper circuit limit on 3 February 2026, propelled by robust buying interest and a significant intraday gain of 5.00%. Despite the company’s micro-cap status and a recent downgrade to a Strong Sell rating by MarketsMOJO, investor enthusiasm drove the stock to its maximum permissible daily price rise, reflecting heightened demand and a regulatory trading freeze.

Read full news article

Prajay Engineers Syndicate Ltd Hits Upper Circuit Amid Strong Buying Pressure

Shares of PraJay Engineers Syndicate Ltd surged to hit the upper circuit limit on 1 Feb 2026, reflecting robust buying interest despite the company’s recent downgrade to a Strong Sell rating. The stock closed at ₹22.46, marking a 0.9% gain on the day and outperforming its Realty sector peers and the broader Sensex.

Read full news article

Prajay Engineers Syndicate Ltd is Rated Strong Sell

Prajay Engineers Syndicate Ltd is rated 'Strong Sell' by MarketsMOJO, with this rating last updated on 08 Dec 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 28 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article Announcements

Prajay Engineers Syndicate Limited - Updates

04-Nov-2019 | Source : NSEPrajay Engineers Syndicate Limited has informed the Exchange regarding 'Sub: Submission of report submitted to SEBI in terms of Regulation 10(7) the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations 2011 with regard to Inter-se transfer between Mrs. D. Hymavathi Reddy (Transferor) and Mr. D. Vijaysen Reddy (Acquirer/ Transferee).

Prajay Engineers Syndicate Limited - Outcome of Board Meeting

25-Oct-2019 | Source : NSEPrajay Engineers Syndicate Limited has informed the Exchange regarding Outcome of Board Meeting held on October 25, 2019.

Prajay Engineers Syndicate Limited - Updates

22-Oct-2019 | Source : NSEPrajay Engineers Syndicate Limited has informed the Exchange regarding 'Sub: Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations, 2018 for the quarter and half year ended 30th September, 2019.

Corporate Actions

No Upcoming Board Meetings

Prajay Engineers Syndicate Ltd has declared 25% dividend, ex-date: 18 Sep 08

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

D Vijay Sen Reddy (31.39%)

Ultimate Money Makers India Pvt.ltd. (3.95%)

46.35%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -41.88% vs -5.46% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -116.28% vs 78.33% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -23.44% vs 195.24% in Sep 2024

Growth in half year ended Sep 2025 is 9.42% vs -18.62% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 34.77% vs 70.36% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 9.68% vs -59.27% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs 92.62% in Mar 2024

YoY Growth in year ended Mar 2025 is 28.88% vs -326.62% in Mar 2024