Compare Precigen, Inc. with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -46.64% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -40.83

Negative results in Jun 25

Risky - Negative EBITDA

Stock DNA

Pharmaceuticals & Biotechnology

USD 1,331 Million (Small Cap)

NA (Loss Making)

NA

0.00%

-0.65

-233.25%

31.79

Total Returns (Price + Dividend)

Precigen, Inc. for the last several years.

Risk Adjusted Returns v/s

News

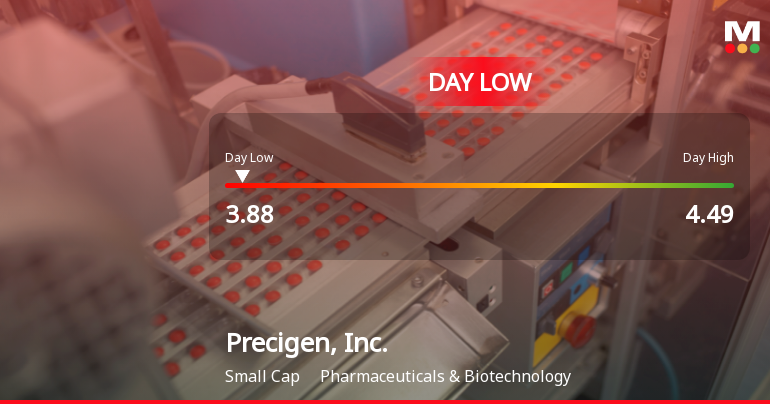

Precigen, Inc. Hits Day Low of $3.88 Amid Price Pressure

Precigen, Inc. experienced notable stock volatility on November 20, 2025, with a significant decline. While the company has shown impressive annual growth, it faces financial challenges, including operating losses and a high debt-to-equity ratio, raising concerns about its long-term growth prospects amidst a fluctuating market environment.

Read full news article

Precigen Stock Opens Weak with 11.75% Gap Down Amid Market Concerns

Precigen, Inc. has opened with a notable loss, continuing a trend of significant declines over the past month. The company's market capitalization is around USD 1.265 billion, with a high return on equity but a negative price-to-book ratio. Technical indicators present mixed signals regarding its performance outlook.

Read full news article

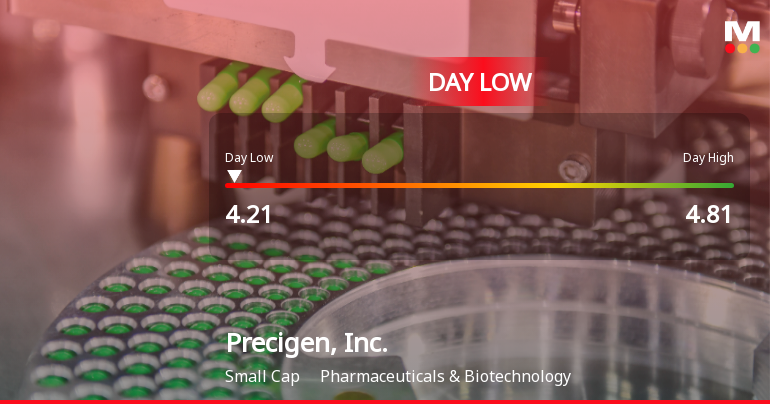

Precigen, Inc. Hits Day Low of $4.21 Amid Price Pressure

Precigen, Inc. faced a notable stock decline today, reaching an intraday low. Despite recent gains and impressive annual returns, the company grapples with significant financial challenges, including operating losses, declining net sales, and a concerning debt situation, indicating a complex landscape in the biotechnology sector.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 33 Schemes (8.03%)

Held by 47 Foreign Institutions (1.67%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is -30.77% vs 8.33% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is 50.92% vs -175.13% in Mar 2025

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is -37.10% vs -76.95% in Dec 2023

YoY Growth in year ended Dec 2024 is -31.60% vs -20.18% in Dec 2023