Compare Premier with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -100.00% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

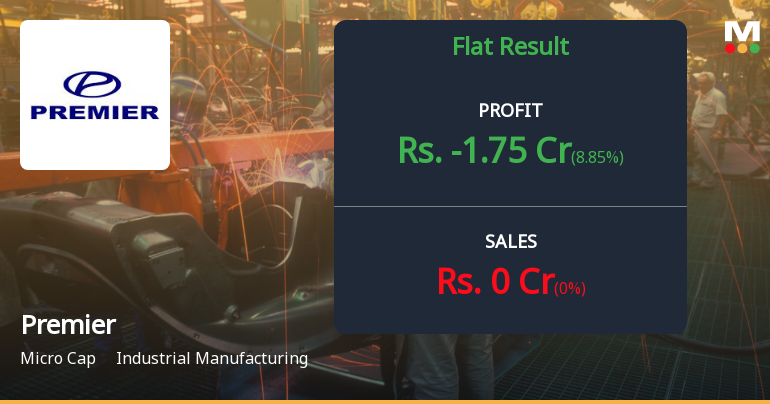

Flat results in Sep 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Industrial Manufacturing

INR 9 Cr (Micro Cap)

NA (Loss Making)

32

0.00%

-0.47

1.94%

-0.03

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Aug-28-2014

Risk Adjusted Returns v/s

Returns Beta

News

Premier Ltd Q2 FY26: Mounting Losses Deepen as Operations Remain Stalled

Premier Ltd., the once-prominent automobile manufacturer now focused on engineering and CNC machines, reported a net loss of ₹0.42 crores in Q2 FY26, representing a dramatic 78.35% deterioration quarter-on-quarter and a 78.57% worsening year-on-year. The micro-cap company, valued at just ₹9.00 crores, continues to operate without generating any revenue, deepening concerns about its viability as losses mount despite zero sales activity.

Read full news articleAre Premier Ltd latest results good or bad?

Premier Ltd.'s latest financial results for the quarter ended September 2025 indicate a challenging operational landscape. The company reported a consolidated net loss of ₹0.42 crores, which reflects a significant deterioration compared to the previous year's loss of ₹1.96 crores. Notably, there were no revenue-generating activities during this period, as net sales remained at ₹0.00 crores, consistent with the previous year. This lack of operational activity underscores the company's ongoing struggle to maintain any viable business model. The operational losses before accounting for other income were recorded at ₹0.70 crores, indicating persistent fixed costs despite the absence of revenue. The reported exceptional other income of ₹1.93 crores during the quarter temporarily masked the underlying operational challenges, suggesting that the company is heavily reliant on sporadic income sources to offset its ...

Read full news article Announcements

Board Meeting Intimation for Intimation Of Board Meeting To Be Held On Friday February 06 2026 At 02:30 P.M.

03-Feb-2026 | Source : BSEPremier Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 06/02/2026 inter alia to consider and approve and take on record the Unaudited Standalone and Consolidated financial results for the quarter ended December 31 2025. This is with reference to our intimation letter dated December 30 2025 regarding closure of trading window for dealing in shares of the Company we further inform that the trading window for dealing in shares of the Company shall remain closed for all Directors/ KMPs/ Designated Persons/ Connected Persons of the Company as defined from Thursday January 1 2026 till Sunday February 08 2026 (48 hours after the unaudited Standalone and Consolidated Financial Results of the Company for the quarter ended December 31 2025 is filed with the exchange).

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

13-Jan-2026 | Source : BSEPursuant to Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 please find enclosed herewith a Confirmation Certificate dated January 12 2026 received from the Registrar and Share Transfer Agent i.e. M/s. MUFG Intime India Private Limited (Formerly Known as a Link Intime India Private Limited) for the quarter ended December 31 2025.

Closure of Trading Window

30-Dec-2025 | Source : BSEWe wish to inform you that pursuant to the provisions of the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations 2015 as amended and the Companys Code of Conduct for Prohibition of Insider Trading Trading Window for dealing in the shares of the Company will be closed from January 01 2026 till 48 hours after the announcement of Financial Results for the Quarter ended December 31 2025 for all promoters directors officers other designated persons and their immediate relatives.

Corporate Actions

No Upcoming Board Meetings

Premier Ltd has declared 30% dividend, ex-date: 28 Aug 14

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 4 Schemes (0.01%)

Held by 1 FIIs (0.0%)

Doshi Holdings Pvt Ltd (27.37%)

Patton Finvest Limited (7.72%)

46.85%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 0.00% vs 0.00% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 8.85% vs 23.20% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 39.33% vs 35.70% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.00% vs 0.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 29.26% vs 32.05% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 21.81% vs 23.74% in Mar 2024