Compare Pritika Auto with Similar Stocks

Stock DNA

Auto Components & Equipments

INR 228 Cr (Micro Cap)

12.00

32

0.00%

0.65

7.15%

0.94

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Sep-20-2019

Risk Adjusted Returns v/s

Returns Beta

News

Are Pritika Auto Industries Ltd latest results good or bad?

Pritika Auto Industries Ltd's latest financial results for Q2 FY26 present a mixed picture. The company reported consolidated net sales of ₹116.45 crores, reflecting a year-on-year growth of 35.77% compared to ₹85.77 crores in Q2 FY25, indicating strong demand in the auto components sector. However, the net profit for the same quarter was ₹5.95 crores, which represents a significant year-on-year decline of 41.09% from ₹10.10 crores in Q2 FY25. This drop in profitability is largely attributed to a high base effect from the previous year, where other income was substantially elevated. The operating margin, excluding other income, stood at 15.99%, showing a slight improvement from the previous quarter but a contraction from the same period last year. The PAT margin also compressed to 5.68%, down from 12.34% year-on-year, highlighting the pressures on profitability due to rising interest costs and the normaliz...

Read full news article

Pritika Auto Industries Q2 FY26: Growth Momentum Faces Margin Pressure Amid Rising Interest Costs

Pritika Auto Industries Ltd., a micro-cap auto components manufacturer, posted a consolidated net profit of ₹5.95 crores for Q2 FY26, representing a sequential growth of 8.18% quarter-on-quarter but a sharp decline of 41.09% year-on-year. The company's stock has faced significant headwinds over the past year, declining 35.67% whilst the broader market gained 7.89%, resulting in a negative alpha of 43.56 percentage points.

Read full news article

Pritika Auto Industries Ltd is Rated Sell

Pritika Auto Industries Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 29 September 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 06 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article Announcements

Corrigendum For Newspaper Advertisements Of Financial Results

10-Feb-2026 | Source : BSEThis is in continuation to our letter dated 09th February 2026 uploading copy of Newspaper publication of Un-Audited Standalone and Consolidated Financial Results for the quarter and nine months ended 31st December 2025 of the Company. As informed you earlier that we came across a printing mistake in the name of Company in the advertisement published in the Punjabi Newspaper. We have issued Corrigendum in this respect in the Rozana Spokesman a Regional Daily Punjabi Newspaper on 10th February 2026. Copy of newspaper cutting is attached. We request you to take it on your record.

Announcement under Regulation 30 (LODR)-Newspaper Publication

09-Feb-2026 | Source : BSEFinancial Results published in Newspapers The Pioneer (in English) and Rozana Spokesman (in Punjabi) today i.e. 09th February 2026This is to further inform you that we came across a printing mistake in the advertisement published in the Punjabi Newspaper. While publishing the name of Company is wrongly published as Pritika Engineering Components Limited instead of Pritika Auto Industries Limited but the remaining matter is correct. However we are taking up the matter with newspaper and will publish a corrigendum in this respect and the same will be submitted with you in due course.

Board Meeting Outcome for Outcome Of The Meeting Of Board Of Directors Held On 7Th February 2026

07-Feb-2026 | Source : BSENote: As the BSE Listing center website was not working the Outcome and Results could not be filed within 30 minutes. We have already informed on BSE email corp.relations@bseindia.com and submitted Outcome and Results on this Id for taking it on record. Dear Sir/ Madam Sub: Outcome of the Meeting of Board of Directors held on 7th February 2026 Pursuant to Regulations 30 and 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 read with Schedule III of the said Regulations the board approved 1. the Unaudited Financial Results (Standalone & Consolidated) for the Quarter and nine months ended 31st December 2025 along with the Limited Review Report (Standalone & Consolidated). 2. Approved to give Corporate Guarantee to Bank of India (Lender) for an amount of Rs. 34.50 Crores. We further inform that the Board Meeting commenced at 12:15 p.m. today and concluded at 01:15 p.m. today.

Corporate Actions

No Upcoming Board Meetings

Pritika Auto Industries Ltd has declared 5% dividend, ex-date: 20 Sep 19

Pritika Auto Industries Ltd has announced 2:10 stock split, ex-date: 09 Apr 21

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.01%)

Harpreet Singh Nibber (41.78%)

Enforcement Directorate Raipur (6.61%)

31.0%

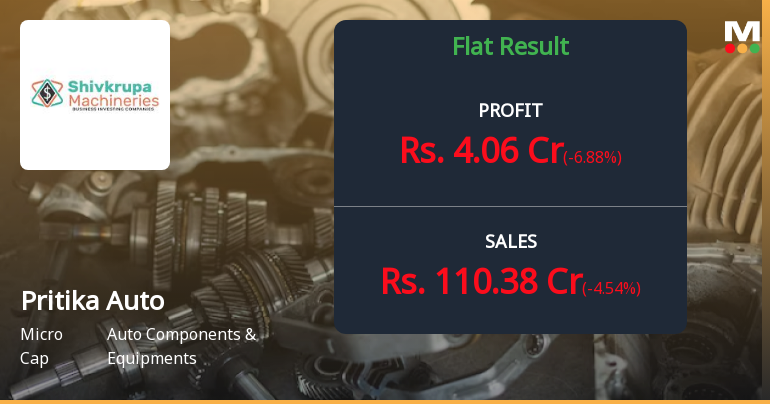

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -2.59% vs 1.61% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -11.93% vs 8.18% in Sep 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 5.20% vs -5.65% in Mar 2024

YoY Growth in year ended Mar 2025 is 41.84% vs 7.39% in Mar 2024