Compare Pure Storage, Inc. with Similar Stocks

Dashboard

Positive results in Jul 25

- NET PROFIT(HY) At USD 33.12 MM has Grown at 99.95%

- INVENTORY TURNOVER RATIO(HY) Highest at 22.86 times

- RAW MATERIAL COST(Y) Fallen by 0.75% (YoY)

With ROE of 10.27%, it has a very expensive valuation with a 14.54 Price to Book Value

High Institutional Holdings at 92.67%

Total Returns (Price + Dividend)

Pure Storage, Inc. for the last several years.

Risk Adjusted Returns v/s

News

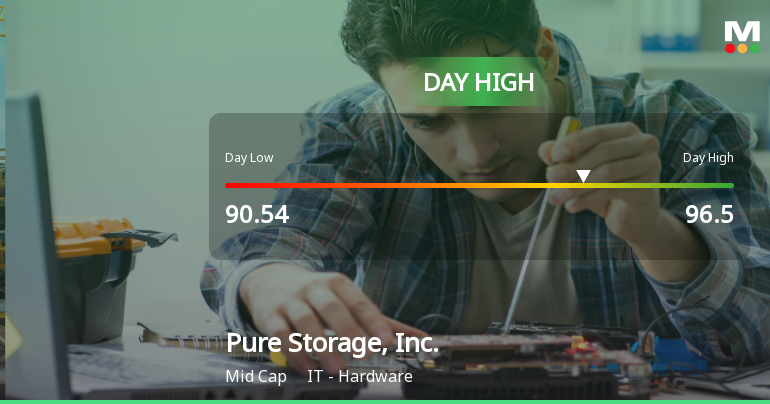

Pure Storage Hits Day High with 6.97% Surge Amid Market Decline

Pure Storage, Inc. has seen notable stock performance today, contrasting with a decline in the S&P 500. Over the past week, the company has shown strong growth, with impressive annual gains. However, it faces challenges, including a decline in net profit and a high price-to-book ratio compared to peers.

Read full news article

Pure Storage, Inc. Experiences Revision in Stock Evaluation Amid Strong Market Performance

Pure Storage, Inc. has recently revised its evaluation amid changing market conditions. The company’s stock price has risen significantly, and it has achieved a remarkable 68.20% return over the past year, outperforming the S&P 500. Its five-year return stands at 382.69%, highlighting its strong market position.

Read full news article

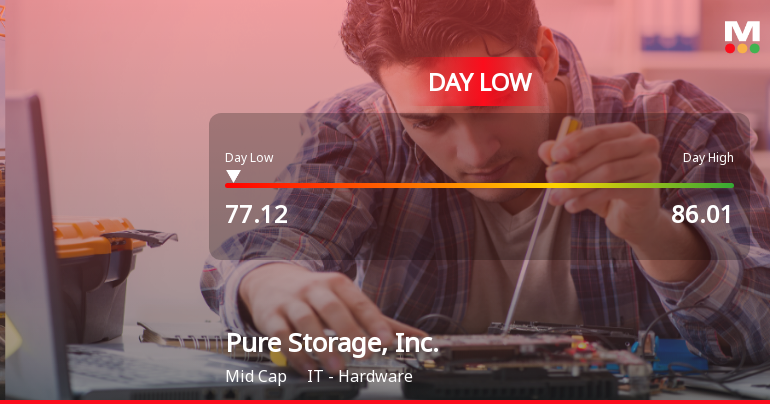

Pure Storage Hits Day Low of $77.12 Amid Price Pressure

Pure Storage, Inc. saw a significant decline in its stock today, contrasting with the S&P 500's modest gain. Despite recent challenges, the company has demonstrated strong long-term growth, with a notable increase over the past year and five years. Its market capitalization is approximately USD 25.98 billion.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 146 Schemes (48.43%)

Held by 347 Foreign Institutions (15.92%)

Quarterly Results Snapshot (Consolidated) - Jul'25 - YoY

YoY Growth in quarter ended Jul 2025 is 12.73% vs 10.90% in Jul 2024

YoY Growth in quarter ended Jul 2025 is 31.93% vs 602.82% in Jul 2024

Annual Results Snapshot (Consolidated) - Jan'25

YoY Growth in year ended Jan 2025 is 11.93% vs 2.80% in Jan 2024

YoY Growth in year ended Jan 2025 is 74.06% vs -16.14% in Jan 2024