Dashboard

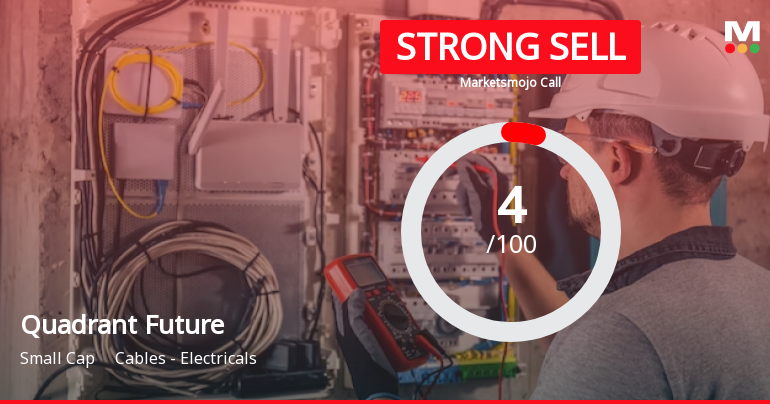

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -0.70% and Operating profit at -195.86% over the last 5 years

Negative results in Sep 25

Risky - Negative Operating Profits

Falling Participation by Institutional Investors

Stock DNA

Cables - Electricals

INR 1,256 Cr (Small Cap)

NA (Loss Making)

63

0.00%

-0.18

-7.29%

4.29

Total Returns (Price + Dividend)

Quadrant Future for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

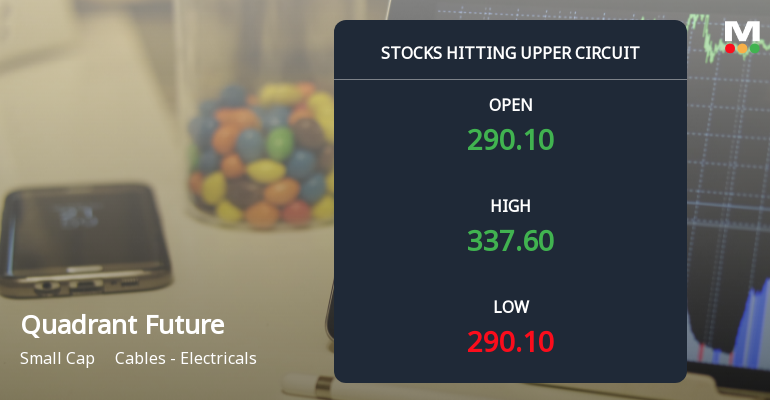

Quadrant Future Tek Hits Upper Circuit Amid Strong Buying Pressure

Shares of Quadrant Future Tek Ltd surged to hit the upper circuit limit on 22 Dec 2025, reflecting robust buying interest and significant market enthusiasm. The stock recorded a maximum daily gain of 19.99%, outperforming its sector and broader market indices, while trading volumes and turnover underscored heightened investor participation.

Read More

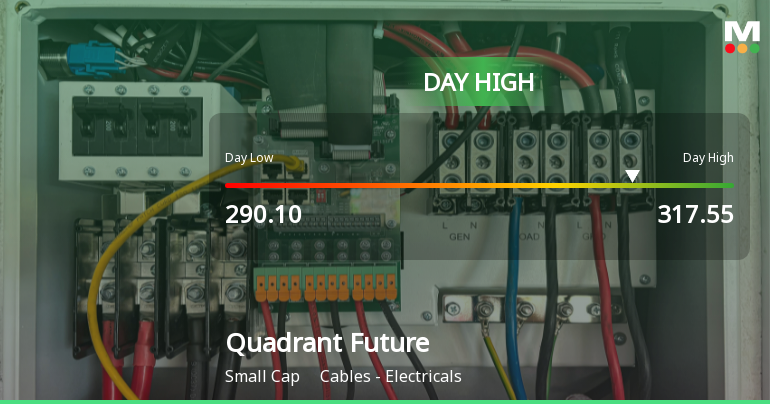

Quadrant Future Tek Hits Intraday High with Strong Trading Momentum

Quadrant Future Tek recorded a robust intraday performance today, reaching a high of Rs 313.3, reflecting a significant surge of 11.36% during trading hours. The stock's strong momentum outpaced its sector and broader market indices, marking a notable session for the electrical cables company.

Read More

Quadrant Future Sees Revision in Market Evaluation Amidst Challenging Financial Trends

Quadrant Future, a small-cap player in the Cables - Electricals sector, has experienced a notable revision in its market evaluation metrics. This shift reflects recent developments across key performance parameters, signalling a more cautious market outlook for the company.

Read More Announcements

Announcement under Regulation 30 (LODR)-Change in Management

29-Nov-2025 | Source : BSEIntimation for cessation of Chief Executive Officer of the Company w.e.f 29th November 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

14-Nov-2025 | Source : BSEIntimation for newspaper Publication of Unaudited financial results for the quarter and half year ended Sep 30 2025

Announcement under Regulation 30 (LODR)-Investor Presentation

14-Nov-2025 | Source : BSEInvestor presentation for the Second Quarter and half year ended 30th September 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 3 Schemes (3.16%)

Held by 7 FIIs (1.56%)

Rupinder Singh (13.5%)

Kotak Mahindra Trustee Co Ltd A/c Kotak Manufacture In India Fund (2.19%)

16.26%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 19.74% vs -50.86% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -17.70% vs -954.43% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -3.09% vs 5.85% in Sep 2024

Growth in half year ended Sep 2025 is -142.81% vs -181.26% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -0.76% vs -0.68% in Mar 2024

YoY Growth in year ended Mar 2025 is -269.36% vs -16.40% in Mar 2024