Compare Quicktouch Tech with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 5.12 times

The company has declared Negative results for the last 5 consecutive quarters

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Computers - Software & Consulting

INR 44 Cr (Micro Cap)

NA (Loss Making)

27

0.00%

0.12

-1.98%

0.24

Total Returns (Price + Dividend)

Quicktouch Tech for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

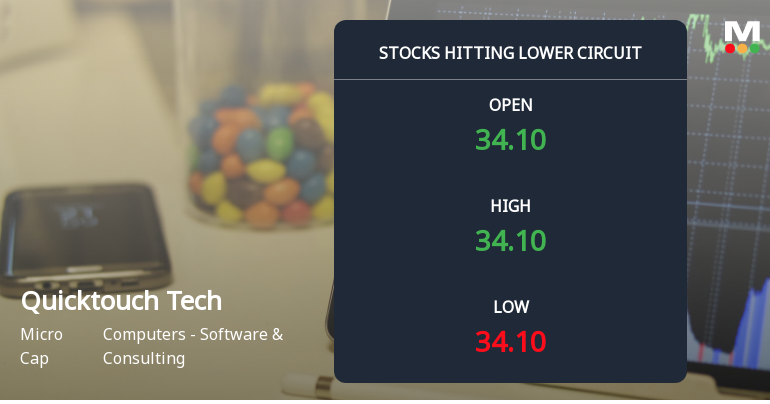

Quicktouch Technologies Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Quicktouch Technologies Ltd, a micro-cap player in the Computers - Software & Consulting sector, witnessed a sharp decline on 2 Feb 2026, hitting its lower circuit price limit of ₹34.10. The stock suffered a maximum daily loss of 4.88%, underperforming its sector and broader market benchmarks amid intense selling pressure and unfilled supply, signalling panic among investors.

Read full news article

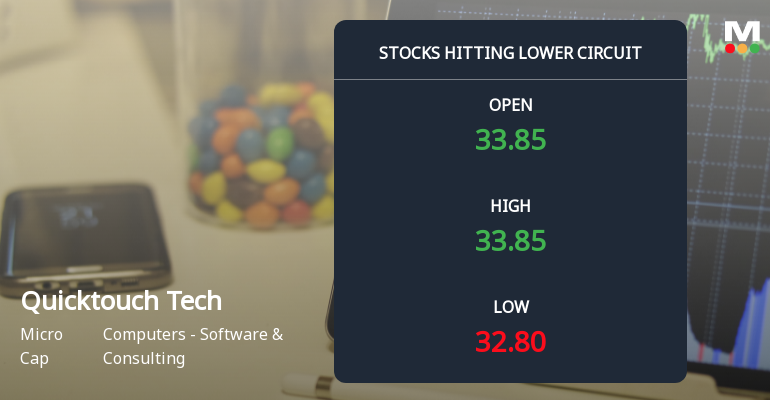

Quicktouch Technologies Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Quicktouch Technologies Ltd, a micro-cap player in the Computers - Software & Consulting sector, witnessed a sharp decline on 28 Jan 2026 as it hit its lower circuit limit, closing at ₹32.80, down 4.93% from the previous close. The stock faced intense selling pressure, reflecting mounting investor concerns amid deteriorating technical and liquidity indicators.

Read full news article

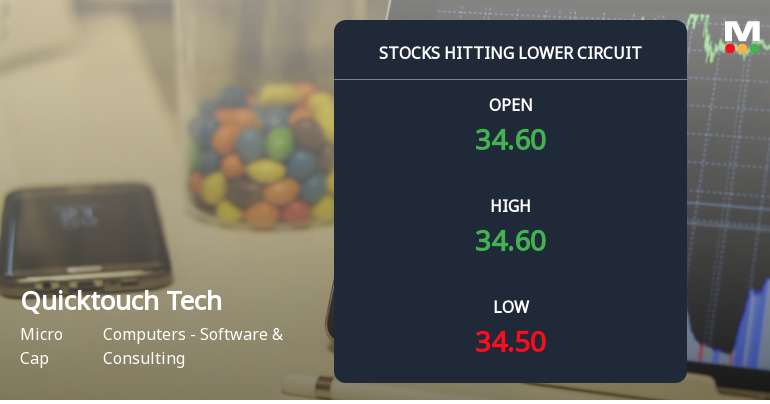

Quicktouch Technologies Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Quicktouch Technologies Ltd, a micro-cap player in the Computers - Software & Consulting sector, witnessed a sharp decline on 27 Jan 2026, hitting its lower circuit limit with a maximum daily loss of 4.96%. The stock closed at ₹34.5, down ₹1.8 from the previous close, reflecting intense selling pressure and panic among investors.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Ram Gopal Jindal (20.35%)

Sandeep Kumar Dhanuka (7.8%)

21.87%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -8.08% vs -89.91% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -33.33% vs 15.81% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -62.49% vs -60.34% in Mar 2025

Growth in half year ended Sep 2025 is -403.35% vs -41.62% in Mar 2025

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -86.91% vs -7.01% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -333.81% vs -24.73% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -24.62% vs 39.04% in Mar 2024

YoY Growth in year ended Mar 2025 is -15.60% vs 5.32% in Mar 2024