Compare QuinStreet, Inc. with Similar Stocks

Total Returns (Price + Dividend)

QuinStreet, Inc. for the last several years.

Risk Adjusted Returns v/s

News

QuinStreet, Inc. Hits New 52-Week Low at $13.53 Amid Decline

QuinStreet, Inc. has reached a new 52-week low, reflecting a significant decline in its performance over the past year. The company, with a market capitalization of USD 936 million, has a high price-to-earnings ratio and does not offer dividends, indicating challenges in the current market landscape.

Read full news article

QuinStreet, Inc. Experiences Revision in Its Stock Evaluation Amidst Competitive Pressures

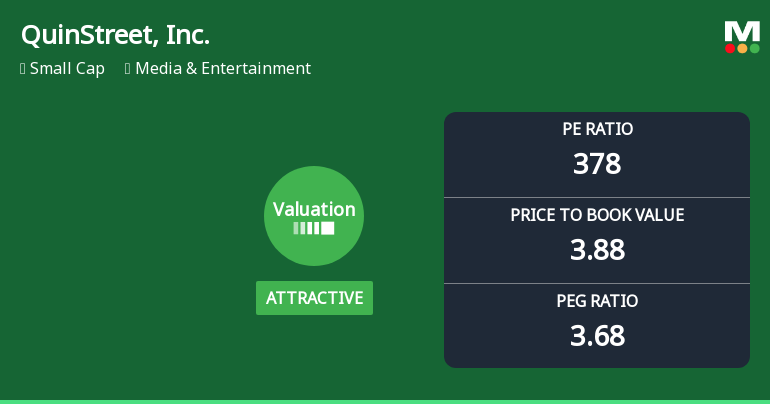

QuinStreet, Inc. has recently adjusted its valuation, revealing a high P/E ratio of 378 and low profitability metrics, including a ROCE of 1.33% and ROE of 1.03%. Compared to peers like Omnicom Group and Interpublic Group, QuinStreet's financial ratios indicate significant competitive challenges within the Media & Entertainment sector.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 60 Schemes (43.34%)

Held by 91 Foreign Institutions (12.74%)

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 9.08% vs -2.85% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 40.62% vs -27.27% in Jun 2025

Annual Results Snapshot (Consolidated) - Jun'25

YoY Growth in year ended Jun 2025 is 78.27% vs 5.67% in Jun 2024

YoY Growth in year ended Jun 2025 is 115.02% vs 54.57% in Jun 2024