Compare Rajoo Engineers with Similar Stocks

Dashboard

With ROE of 16.5, it has a Expensive valuation with a 3.4 Price to Book Value

- The stock is trading at a discount compared to its peers' average historical valuations

- Over the past year, while the stock has generated a return of -67.61%, its profits have risen by 105.3% ; the PEG ratio of the company is 0.2

Falling Participation by Institutional Investors

Underperformed the market in the last 1 year

Stock DNA

Industrial Manufacturing

INR 1,140 Cr (Small Cap)

18.00

37

0.23%

-0.35

16.47%

3.52

Total Returns (Price + Dividend)

Latest dividend: 0.15 per share ex-dividend date: Sep-19-2025

Risk Adjusted Returns v/s

Returns Beta

News

Rajoo Engineers Ltd is Rated Sell

Rajoo Engineers Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 01 February 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 23 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news articleAre Rajoo Engineers Ltd latest results good or bad?

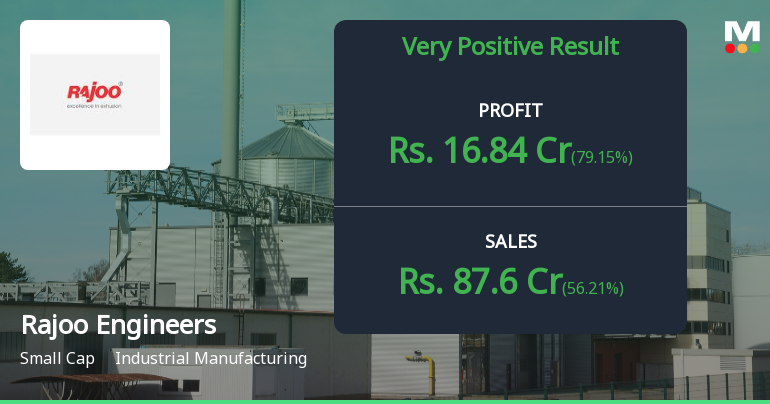

Rajoo Engineers Ltd has reported its financial results for the quarter ended December 2025, showcasing significant year-on-year growth in both revenue and net profit. The company achieved net sales of ₹87.60 crores, reflecting a year-on-year increase of 56.21%, while net profit reached ₹16.84 crores, marking a 79.15% rise compared to the same quarter last year. This performance is underscored by an operating margin of 25.42%, which is the highest recorded by the company, indicating effective cost management and operational efficiency. The nine-month performance for FY26 also demonstrates strong momentum, with consolidated net profit of ₹46.04 crores on revenue of ₹264.92 crores, representing year-on-year growth of 111.45% and 61.98% respectively. This suggests that Rajoo Engineers is effectively leveraging its operational capabilities to drive profitability alongside revenue growth. However, it is importa...

Read full news article

Rajoo Engineers Q3 FY26: Profit Surge Masks Valuation Concerns as Stock Tumbles 66% YoY

Rajoo Engineers Ltd., a Gujarat-based industrial manufacturing company specialising in extrusion machinery, reported a robust 79.15% year-on-year surge in consolidated net profit to ₹16.84 crores for Q3 FY26 (October-December 2025), up from ₹9.40 crores in Q3 FY25. However, the impressive operational performance has failed to arrest a brutal stock price decline, with shares plunging 65.99% over the past year to ₹69.34, significantly underperforming both the Sensex and the broader industrial manufacturing sector.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

21-Jan-2026 | Source : BSENewspaper Publication of Unaudited Standalone and Consolidated Financial Results for the quarter and nine-months ended December 31 2025

Board Meeting Outcome for Unaudited Standalone And Consolidated Financial Results For The Quarter And Nine-Months Ended December 31 2025

20-Jan-2026 | Source : BSEOutcome of Board Meeting dated January 20 2026 for consideration and approval of Unaudited Standalone and Consolidated Financial Results for the quarter and nine-months ended December 31 2025

Results

20-Jan-2026 | Source : BSEUnaudited Standalone and Consolidated Financial Results for the quarter and nine-months ended December 31 2025

Corporate Actions

No Upcoming Board Meetings

Rajoo Engineers Ltd has declared 15% dividend, ex-date: 19 Sep 25

Rajoo Engineers Ltd has announced 1:10 stock split, ex-date: 17 Sep 09

Rajoo Engineers Ltd has announced 1:3 bonus issue, ex-date: 02 Dec 24

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 12 FIIs (1.74%)

Rajesh Nanalal Doshi (11.12%)

None

31.11%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 56.21% vs -6.66% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 79.15% vs 54.35% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 64.68% vs 27.07% in Sep 2024

Growth in half year ended Sep 2025 is 118.27% vs 71.48% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 61.78% vs 13.08% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 102.15% vs 63.98% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 28.53% vs 23.51% in Mar 2024

YoY Growth in year ended Mar 2025 is 81.44% vs 82.85% in Mar 2024